Corporate Tax in UAE: Key Takeaways and Next Steps

Introduction

“31 January 2022 is a date that is going to be remembered in the history of the UAE. On this date, the Ministry of Finance announced introduction of tax on income from business and commercial activities in the UAE.”

Over the last one, one and half years, we have been discussing whether the UAE will bring in corporate tax or not. It has now been announced and soon it is going to be a reality.

In May 2018, UAE joined OECD’s BEPS (Base Erosion and Profit Shifting) project by signing the inclusive framework and subsequently brought in few legislations such as the Economic Substance Regulation (ESR) and Country by Country Reporting (CbCR), which were basically to assist in avoid harmful tax practices. These are part of the 15 Action points in the BEPS project, what UAE had initially signed on.

When Pillar One and Pillar Two tax blueprints or reports were released by OECD, they were widely accepted by G7 and G20 countries. It was a foregone conclusion that all signatories to the BEPS project, including UAE, would have to implement some sort of taxes on business income.

UAE surprised the businesses by announcing 9% corporate tax – amongst the lowest in the world. However, the large multinationals would be taxed at a different rate (to be announced later by the Ministry of Finance). The CT regime will start will become effective from the financial year on or after 1st June 2023.

Transaction tax vs Income Tax

Before we delve further into Corporate Tax, let us understand the difference between transaction tax and income tax or corporate tax for todays session.

Transaction tax is a tax levied on transactions - for instance we have VAT and Excise Tax in the UAE. Not all transactions have the same rate of VAT. Some have standard rate; some are zero-rated and some exempt and some out of scope.

Difference between Transaction Tax & Income Tax

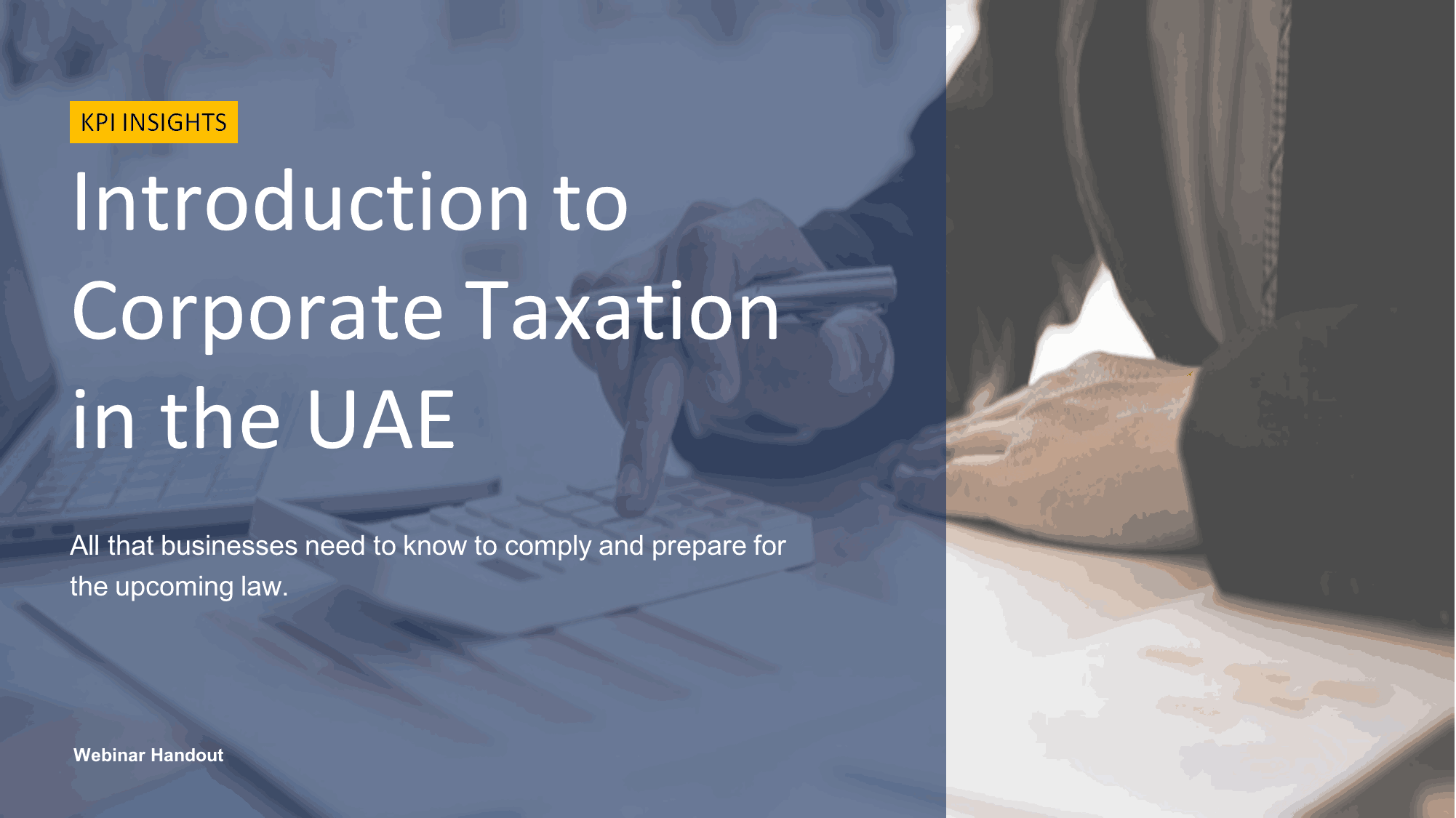

Income Tax or Corporate Tax (what we are discussing today) is a tax on profits earned by an entity. To arrive at the profits, we prepare income statement where we aggregate all the transactions during the year – sales, purchases, expenses and also provisions.

Let’s take a quick example to understand further:

This is a sales invoice of a company. The same value is 10,000 AED. When we aggregate that, it comes in the Income Statement in the form of revenue. The revenue in our example is 1,000,000 AED. VAT here is not to be considered, because VAT is not an Income Statement item, it is a Balance Sheet item. Corporate Tax is all to do with P&L or Income Statement.

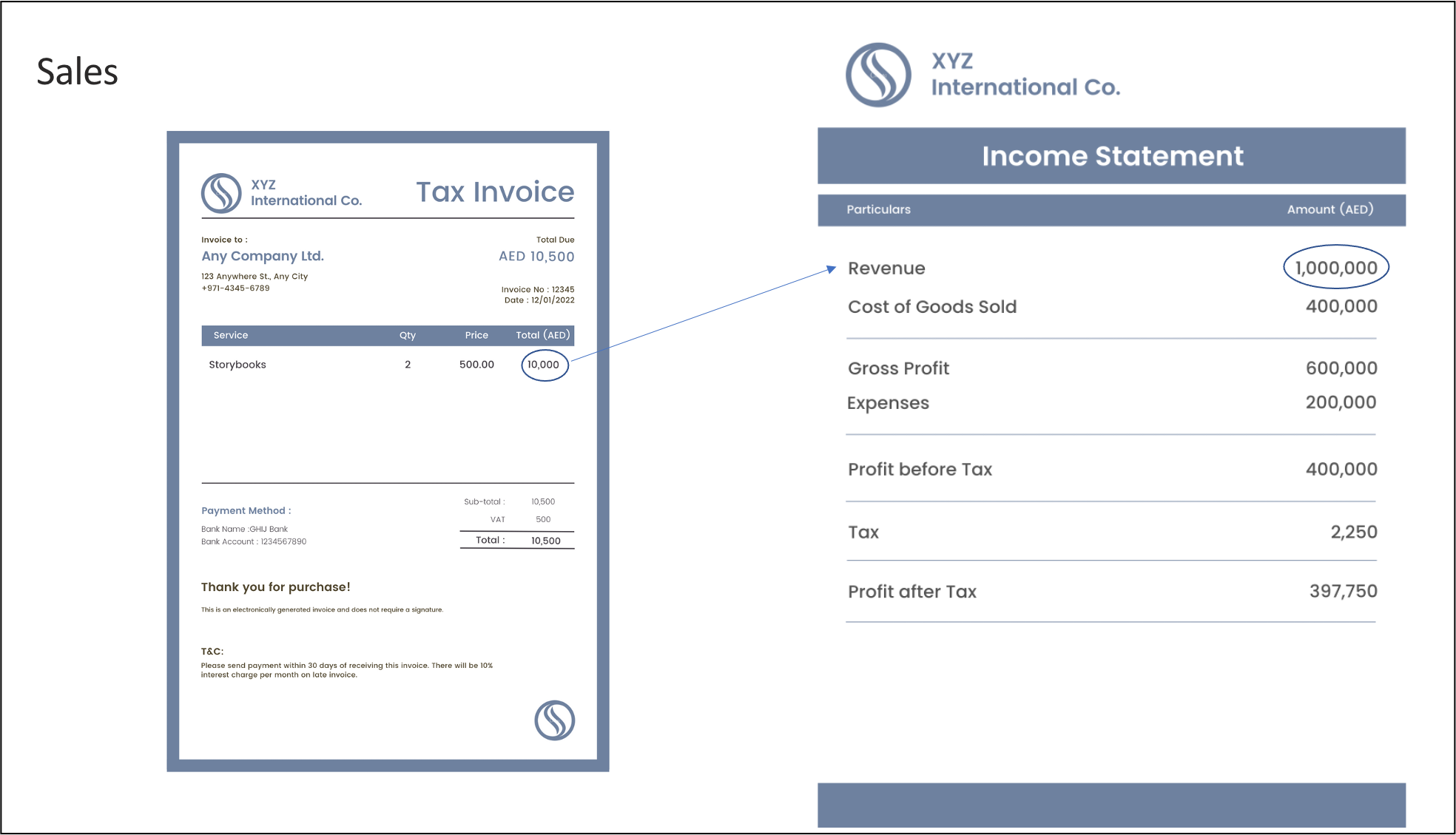

Likewise, when we purchase goods, we treat them as Cost of Goods Sold (COGS) and reduce it from the revenue to arrive at Gross Profit. In this example, purchase cost is 5,000 AED which gets aggregated in the 400,000 AED as COGS.

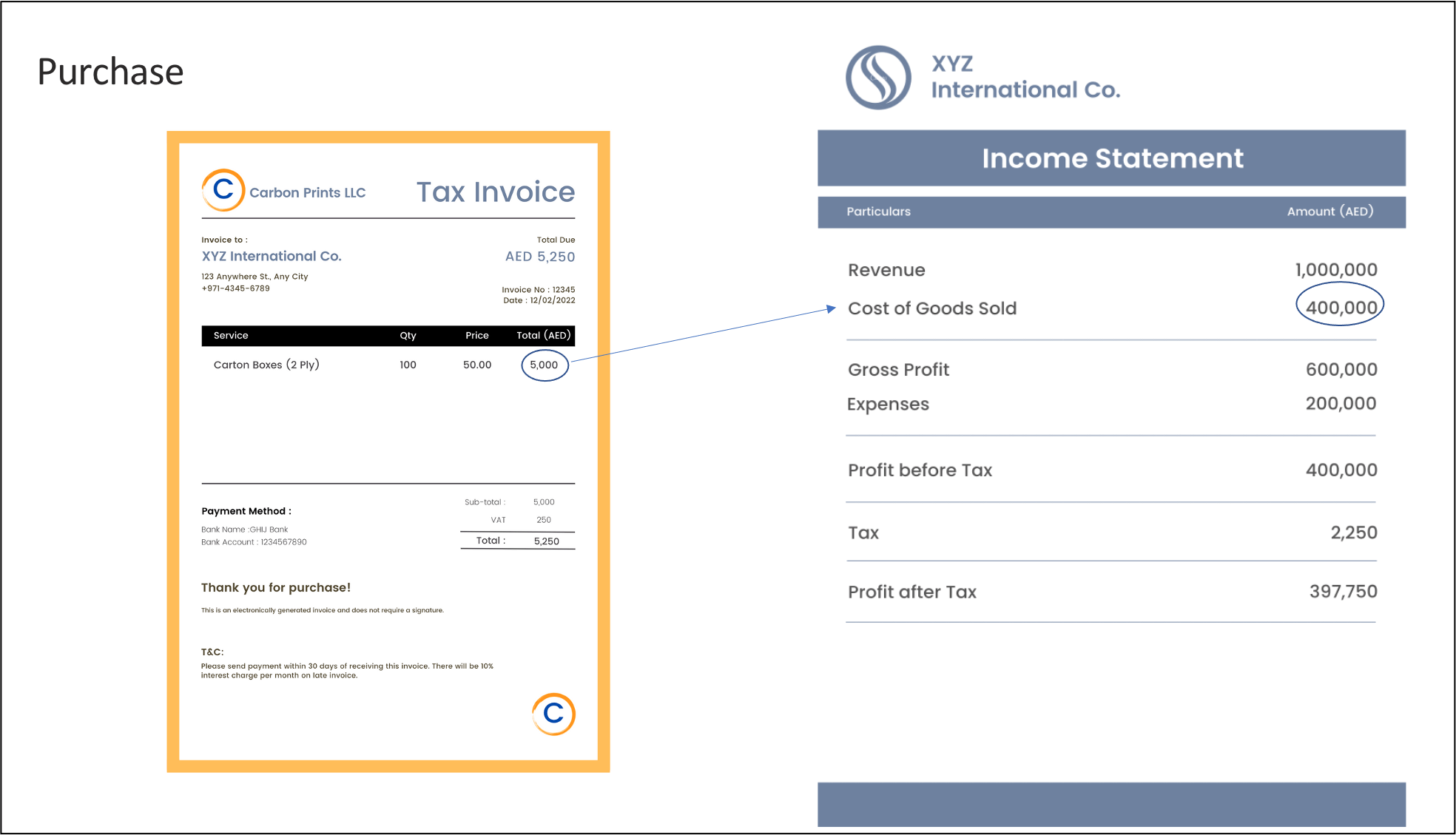

Similarly, we have admin and other expenses which aggregates in our example to 200,000 AED and which results in profit before tax of 400,000 AED. Now, we will be discussing further the different tax slabs. We all know that the UAE government has two tax slabs:

- up to 375,000 AED of profit earned would be at 0 rate, and

- above 375,000 AED would attract a tax rate of 9%.

So, in this example, we have a profit before tax of 400,000 AED; subtracting 375,000 AED we come to a taxable profit of 25,000 AED. And 9% corporate tax rate of 25,000 AED is 2,250 AED - which is the tax payable on the profit.

We will discuss this more in the next few sections.

Applicability of Corporate Tax

Applicability of Corporate Tax

Talking about the applicability of Corporate Tax - Yes, it is applicable to all businesses and commercial activities. It maybe entity, freelancer or anybody who gets an income from a business or commercial activity. The only exception made aware is Oil & Gas, Natural Gas extraction companies are exempted from this announcement. This is because these are already under a separate taxation by individual emirates.

From our above example, the profit and loss account is quite straightforward. For arriving at the income tax purpose profit, we have to consider certain adjustments, that would be specified in the CT law we are waiting for. And the net profit, post these adjustments would be accepted. A point to note here is when we prepare the income statement, it has to be in accordance with internationally accepted accounting standard. Going forwards, for income tax purposes, the accounts needs to be audited. The authorities will reply on audited accounts to understand whether the profits are as per the internationally accepted accounting standards.

About the financial year being on or after 1st June 2023 - unlike many other countries, for e.g., in India the financial year is April to March for tax purposes and accordingly every company has to prepare a balance sheet, P&L account and calculate the taxability based on that financial year. Here in UAE, as per the CT FAQs published, it is any financial year starting on or after 1st June 2023. So, if financial year is January to December, the first taxable financial year would be 1st January 2024 to 31st December 2024. This is a step taken from the ESR report as we all are aware. It is the 12 months period financial year, you can have any financial year that you would like to continue with (ESR notifications submitted 6 months before financial year end and reports submitted by the end of financial year).

Quick Reminder: For companies following the April to March financial year, we are quickly approaching the deadline for filing the ESR reports with FTA. Assistance can be provided as required.

For registration purposes - all entities are required to register with FTA.

Points to Ponder:

At this juncture, we will have to wait to understand:

- Whether private trusts and foundations would be taxed. If yes, what would be the rate?

- Will there be tax benefits for Emiratis/GCC nationals shareholding? (Like in KSA or Qatar)

Corporate Tax Rates

Rate of Corporate Tax

As we discussed, there are two tax slabs:

- up to 375,000 AED of profit earned would be at 0 rate, and

- above 375,000 AED would attract a tax rate of 9%.

All large corporates based as per the OECD directives (corporate with group turnover of over 3.15 Billion AED) would be taxed at a different rate.

Two specific income parts that are dividend and capitals gains earned by qualifying shareholder (to be defined in the CT law) would be exempt from in the taxable income list. Any company earning dividend or capital gains - it will be a deduction from total income and no tax will be paid on such dividend and capitals gains.

In other jurisdictions like KSA, there are advance tax requirements like 3, 6 and 12 months. In UAE, there won’t be any advance tax payable. Also, there would be no withholding tax in UAE. Investment returns of a foreign investor in the UAE (dividends, capital gains, interest, royalties, or other investment returns) would not be taxed. Similarly, if income includes portion which has been taxed outside of UAE, the MoF has proposed that such credit made available on the total income.

Points to Ponder:

Certain income like income from rental is not commercial in nature. We will have more clarity on Structuring – Personal income vs business income.

Related Parties

Corporate Tax - Related Parties

This is one of the challenging as well as interesting areas in the CT law. The UAE government has already decided that Transfer pricing rules will be applicable for businesses in UAE. Most probably, we will have to follow the OECD Transfer Pricing guidelines.

Any company which is an MNC - that has presence is more than 1 jurisdiction, needs to start preparing for Transfer pricing regulations.

The UAE government is also allowing businesses to form Tax Groups - very similar to what we have in place for VAT purpose. There will be a criterion under which we can identify which are the companies under same management, same group and we can form Tax Groups, electing to file a single return. It is only for the purpose of administrative ease. For instance, a group with 10 companies need not file 10 different returns, instead they can form a tax group and file one return. However, all the 10 companies need to get their accounts audited and do a separate calculation of tax and do an aggregation. If one of the companies in the tax group is a loss-making company, you can set it off against the profits of the other companies. There is also a provision of carrying forward the losses which will be discussed subsequently. In case of group, you can claim the losses upfront, rather than carrying it forward and adjusting with future profits.

Points to Ponder:

- What would be the tax-free limit in case of a tax group?

- We know that up to 375,000 AED, it’s a zero-tax slab. So, let’s say in a group of 10 companies, would it be 375,000 AED or would it be 375,000 AED x 10? Ideally, as per the principle of justice, it should be 375,000 AED x 10, but we will have to wait and watch what the law says.

- Will there be a limit on managerial remuneration or Management Fees?

- The answer to this is possibly yes. There are certain restrictions on interest payments as well as group companies or shareholder loans, there will be a cap. Let wait for the law to be out to seek more clarification.

Treatment of Business Losses:

Treatment of Business Losses

The Corporate Tax Law would provide for set-off and carry forward of taxable business losses. We will have to see the rules and limitations.

Points to Ponder:

Will the CT Law provide for losses to be carried forward fixed period or fixed limit with unlimited period? For example, in KSA losses can be carried forward for an unlimited period but there is a cap of 25% of losses or profits that we can set-off. Whereas, Oman has a limit of 5 years within which claims can be made, otherwise the losses are lapsed. We have to wait for the law to give us further clarification.

Free Zones

Corporate Tax for businesses operating in Free Zone

One of the most important business structuring in this part of the world are free zones. Companies in free zones have been provided CT incentives of 25-50 years, depending upon various free zones. The question remains however, that when the federal law on CT will be implemented, will it also cover the free zone companies. In the CT FQAs, the government has mentioned that they would be interested in giving benefits to companies in free zones provided:

- they meet all the registration conditions and

- do not conduct business with the mainland in UAE.

Points to Ponder:

What would be taxed – the entire income or proportionate income?

If suppose they are doing business with mainland, would the entire income be taxed or only to certain portion of income which is generated from business with mainland companies? We will have to await for the law to be published and give us an answer.

Administration of Corporate Tax

Administration of Corporate Tax

The FTA was setup in 2017 and its main role was the entire administration and enforcement of various taxes which are going to be enforced in the country. When FTA was formed, VAT was implemented, and FTA was given the responsibility for administration, collection and enforcement of VAT as well as the excise. Likewise, in 2020 when the ESR and CbCR were implemented, the FTA was given then responsibility of assessment. Anything to do with tax needs to be monitored by a single authority. In this case also, the government has identified that the FTA would be responsible for the entire administration and Ministry of Finance (MoF) will be the Competent Authority, only for purposes of bilateral/multilateral agreements and the exchange of information for tax purposes.

Points to Ponder:

Over the last many years, businesses have already been filing excise, VAT and ESR with the FTA. The FTA already has all the business information.

That was all with respect to Corporate Tax announcement made by the MoF.

Comparative Landscape of Corporate Tax in GCC

Corporate Tax Landscape in GCC

It will be appropriate to compare the CT with various other jurisdictions in the GCC region. The next sections will have more information on that, for discussion purposes. We have summarized information of 4 countries, including UAE namely KSA, Qatar, Oman.

What’s Next?

Let’s have a look at the impact of Corporate Tax on a few important areas:

Foreign Direct Investments

FDI will still continue to flow into the UAE. The Corporate Tax rate set is only 9% - lowest in the jurisdiction, which will not be a deterrent. FDI will still flow into the country and will be good for business.

Mergers & Acquisitions

Will M&As stop or still happen? The only point to note here is there will be an increased benefit for advisors. Now there will be a need for tax due diligence, in addition to financial due diligence. A 9% tax rate is quite nominal and will not hinder M&As.

Compliance with ESR & CbCR

ESR & CbCR were only implemented as UAE was a zero-tax or no tax jurisdiction. Now with Corporate Tax coming in, we presume that compliance with respect to ESR will go. At the same time, companies that 100% in free zones and exempted and outside of the purview of CT will still need to continue with ESR notifications and reports. For others, the government apparently will do away with ESR compliance. We will have to wait and watch.

Inflation

When Corporate Tax comes in, businesses will definitely not want to bear this in their balance sheet and try to pass on. It might increase the prices of products and services, leading to increase in the inflation rate. We will have to wait and watch for this as well.

How can businesses get ready for the Corporate Tax Law?

Preparing for Corporate Tax - What businesses need to do?

There are certain things can be done right away, without waiting for the law to come. Couple of these are:

- Review of Business Activities

- Start looking into how business is structured - free zone, mainland activities - do an analysis and find out what’s best for your type of business.

- Accounting & Bookkeeping

- Start looking the accounting & bookkeeping requirements. If you are following or not following IFRS, IAS? There may be additional requirements like IAS12 that will need to be looked into.

- Transfer Pricing

- As discussed, if you are an MNC having presence in multiple tax jurisdictions, most probably you will have to follow the OECD Transfer Pricing guidelines. These are out already and available to discuss.

- Upskill/Reskill concerned resources

- The accounting and finance department needs to be trained and upskilled to be ready for implementation of the CT law.

- Technology

- There might be a requirement for businesses to make changes in their current Chart of Accounts, etc. and technology will play an important role in the way a business manages its accounting and finance functions.

It is time for businesses to consider the impact of the newly introduced Corporate Tax. Our tax experts at KPI would be happy to guide you on what actions you need to take to follow the law, once it becomes effective.

Send Inquiry