Legal Structure

Operates in a Common Law Jurisdiction

The Abu Dhabi Global Market's Special Purpose Vehicles (SPVs) protect parent company assets and liabilities through their distinct legal status from financial and legal risks. SPVs have a separate legal status. The creditors of the SPV cannot claim or attach the assets of the parent company or the shareholders of SPVs. This robust framework allows flexibility preventing creditors' access to parent company assets or SPV shareholder holdings.

Operates in a Common Law Jurisdiction

Filing audited financial documents as per requirements

Low Registration and Operating Costs

Simple Ongoing Reporting Requirements

Migration and Continuance Permitted, No Attestation Required for Corporate Documents

Learn MoreNo Physical Registered Address Requirement, Minimum One Shareholder/Director, Corporate Shareholder/Director Permitted, Company Secretary Not Required, Restricted Scope Company Available

Learn MoreNo Minimum or Maximum Share Capital, No Restriction on the Maximum Number of Shareholders, Multiple Classes of Shares with Varying Rights Allowed (Including Fractional Shares)

Learn MoreTax Efficient Structure , Unlock DTAA Benefits with Tax Residency Certificates

Learn MoreSPVs and foundations that demonstrate to the satisfaction of the Registrar they meet the below exemption criteria.

ADGM requires all SPVs to prove Nexus requirement. This can be satisfied by any of the following:

Streamlining your SPV experience with expert care and precision.

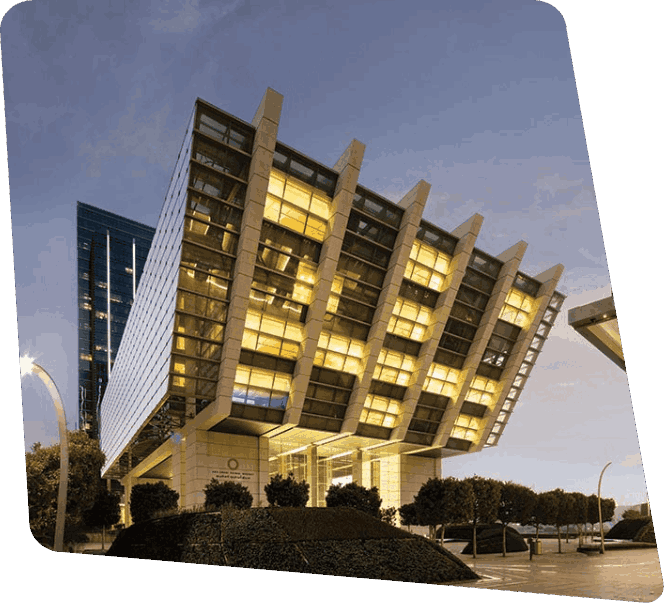

ADGM or Abu Dhabi Global Market is an award-winning international financial centre strategically located in the capital of the United Arab Emirates. Established by UAE Federal Decree, ADGM's jurisdiction extends across the entire 114 hectares of Al Maryah Island.

Yes, All ADGM-registered companies are eligible to apply for a Tax Residency Certificate from the UAE Ministry of Finance to benefit from the UAE’s extensive double tax treaty network.

ADGM SPV can be of two types,

Once all the required documents are submitted online on ADGM portal, it takes about a week for ADGM to review and issue the incorporation certificate. ADGM might request for additional documents or seek clarification on the documents submitted.

ADGM fees for setting up of SPV is USD 1,600. Annual renewal fees is USD 1,200

There are no restrictions on who can set up an ADGM SPV. It can be an individual or a corporate entity but a minimum of one shareholder is required.

ADGM also provides the option, to applicants meeting certain criteria, for an SPV to be formed as a ‘Restricted Scope Company’ (RSC). RSCs are required to make only limited information disclosure on the public register although full disclosure to the ADGM Registrar is mandatory.

No. ADGM SPVs are not entitled to obtain visas.

Any company incorporated at ADGM requires a physical registered office address. However for SPV and Foundations, under the new CSP regime, CSP will provide the registered office address for the SPVs and Foundations.

There are no restrictions on shareholding. No maximum numbers of shareholders and no maximum amount of share capital. However, the SPV might be required to identify the Ultimate Beneficiary Owner of the SPV as per the regulations.