- Does UAE CT allow for carry forward of losses?

- Can a business carry forward business losses before June 2023?

- What is the maximum amount of losses that can be carried forward?

- Can Tax Group be an effective mechanism to adjust losses?

- What are the business losses that cannot be carried forward?

- What are the conditions to carry forward losses?

- The Wrap

Corporate Tax: Loss carry forward - What, When and How much?

Updated on : 28 May 2024

Published : 21 Jun 2022

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

Profit is the primary goal of any business. Whether a startup or a behemoth, the ultimate goal is to maximize shareholder wealth.

But, then it is not always possible to generate a profit. Losses are unavoidable, especially in the early years of operations. Even companies that have been around for decades might lose money at times.

Companies must pay corporate taxes on taxable income. In the years they make profits.

How are losses handled?

Is it possible to carry over the losses to future years?

How long will it be?

What are the requirements?

These are the questions that every investor should ask and have answers to

So, let us find out!

Does UAE CT allow for carry forward of losses?

Yes, the proposed UAE CT regime allows the carry forward of losses incurred. Such losses can be adjusted against its future profits.

Subject to conditions.

Can a business carry forward business losses before June 2023?

Obviously, No. There were no taxes on business income earlier. As a result, Losses pertaining to financial years prior to the introduction of the CT regime will not be allowed to be carried forward.

For the purposes of the CT, the first financial year begins on or after June 1, 2023. Any losses suffered by a company after the CT regime went into effect would be carried forward.

What is the maximum amount of losses that can be carried forward?

There are no limits as such. All the losses incurred can be carried over.

Losses can be carried forward indefinitely.

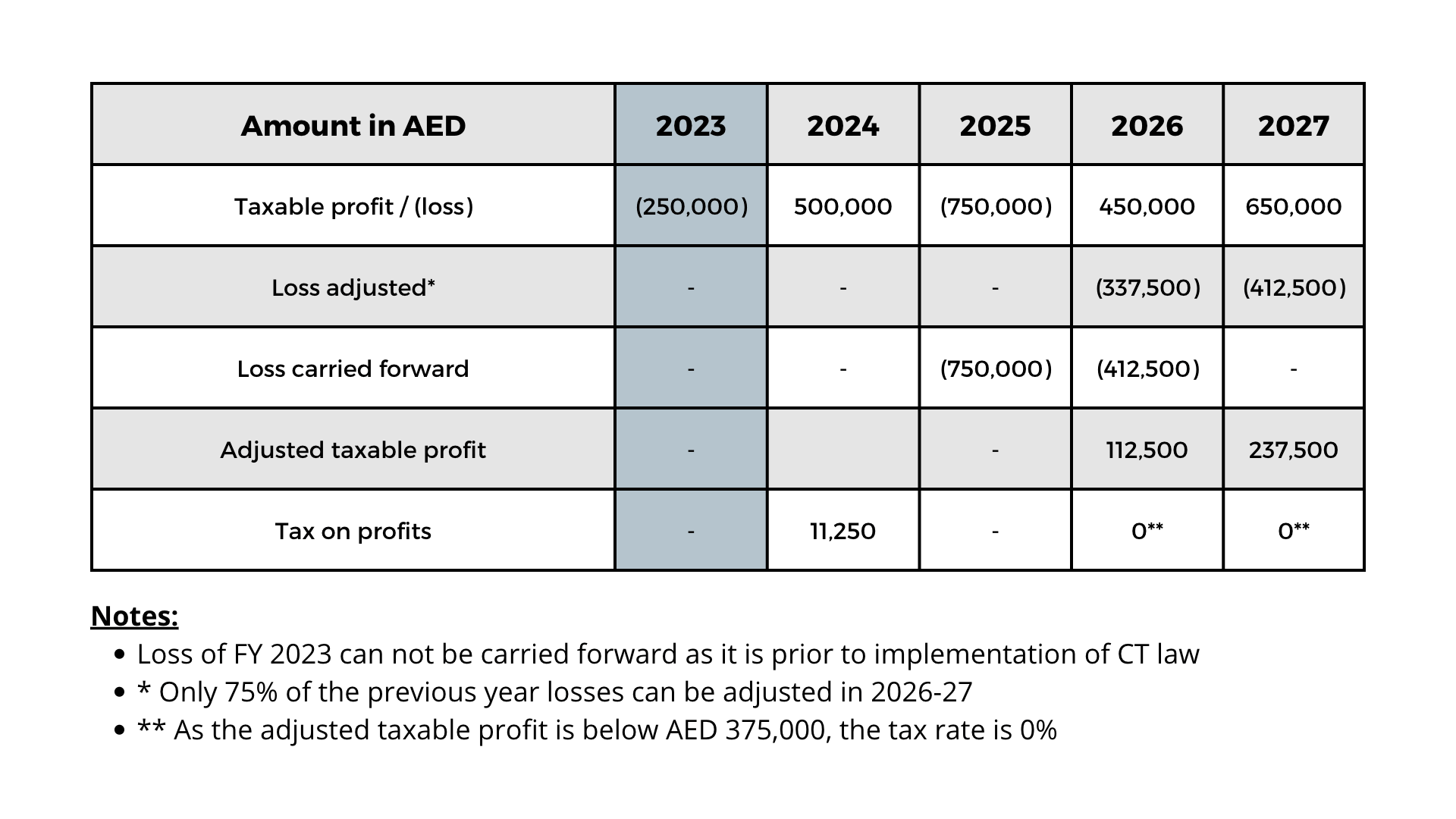

However, in any given year, the amount of set-off allowed is limited to a maximum of 75 percent of taxable income

This means that even if all accumulated losses are not entirely offset, the business must pay taxes on 25% of its taxable income.

To demonstrate, consider the following scenario:

Can Tax Group be an effective mechanism to adjust losses?

Forming a tax group can be beneficial to a certain extent. This question is more fully answered here.

What are the business losses that cannot be carried forward?

Following losses are not eligible to carry forward to subsequent years:

- Only losses incurred by a company after the CT regime comes into effect would be carried forward. Losses incurred before the effective date of UAE CT are not eligible to carry forward.

- Losses incurred before a person becomes a taxpayer for the UAE CT purposes,

- Losses incurred from activities or assets which generate income that is exempt from UAE CT, or

- Losses incurred by a Free Zone Person that is not attributable to a PE on the mainland.

What are the conditions to carry forward losses?

Carry forward of business losses allowed under the following conditions:

- Some shareholders hold at least 50% of the share capital from the beginning of the loss period till the time the losses are completely set off or adjusted.

- If more than 50% of shares are sold to a new shareholder, the business can still set off the losses if the new shareholder continues to carry on with the same or similar business. (Please note that this condition is not applicable if the business is listed on a recognized stock exchange.)

The Wrap

Losses are something that no company wants to experience. When things go wrong, though, losses are unavoidable. Losses may occur more frequently than expected.

A business would hope, at the very least, to be able to carry forward losses to the following year. To lower the tax payment in profitable years.

The UAE CT regime would allow taxable losses to be carried forward and set off. For an indefinite period. With conditions.

LEAVE A REPLY

Related Topics

2 years ago

21 Jun 2022

KPI

Corporate Tax in UAE: Consultation document UAE Ministry of Finance

Have a say in how the UAE Corporate Tax laws should be - submit your comments and learn more about the new CT Law.

2 years ago

20 Jun 2022

KPI

UAE Corporate Tax Rates: How to Calculate your tax liability

Calculating your tax liability under the Corporate Tax Law.

2 years ago

20 Jun 2022

KPI

Are companies in UAE Free Zones subject to Corporate taxes?

Find out how the UAE CT regime would honour tax incentives for Free Zone Persons.

2 years ago

04 Nov 2022

KPI

UAE Tax Residency Certificate (TRC): What? Why? And how?

UAE Tax Residency Certificate (TRC): What? Why? And how?

2 years ago

17 May 2023

KPI

Corporate Tax in the UAE: Can You Change Your Tax Period?

Can you change your tax period for the UAE Corporate Tax? What are the possible reasons for the change? How to align your financial year? Get the answers here!

2 years ago

06 Feb 2022

KPI

New Corporate Tax in UAE: All You Need to Know

The Corporate Tax Law is a Federal Law that will apply to all businesses and commercial activities(legal entities)in the UAE. Find out more.