- Understanding Tax Groups

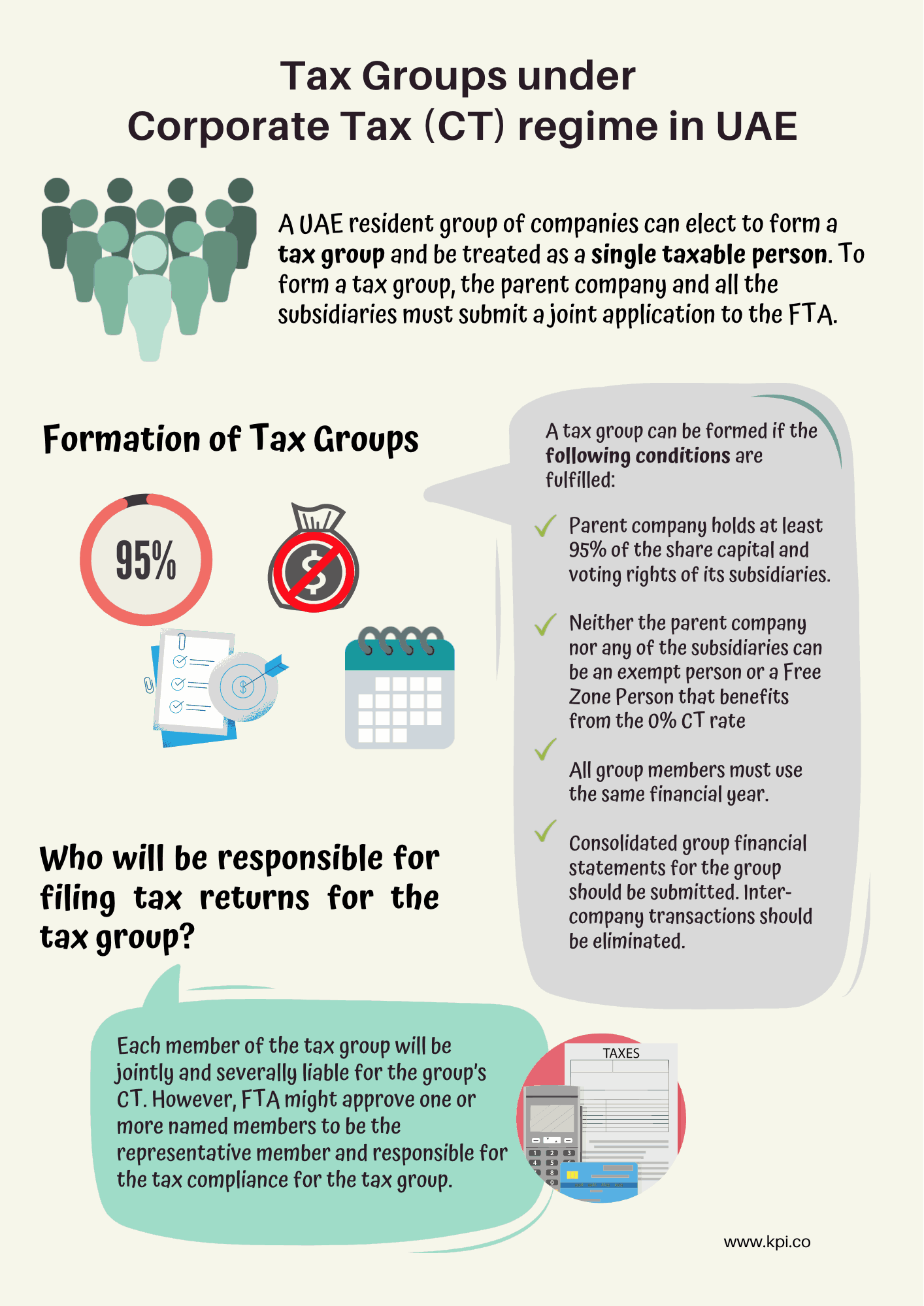

- 1. Formation of Tax Groups

- 2. How to form a Tax Group?

- 3. Who will be responsible for filing tax returns for the tax group?

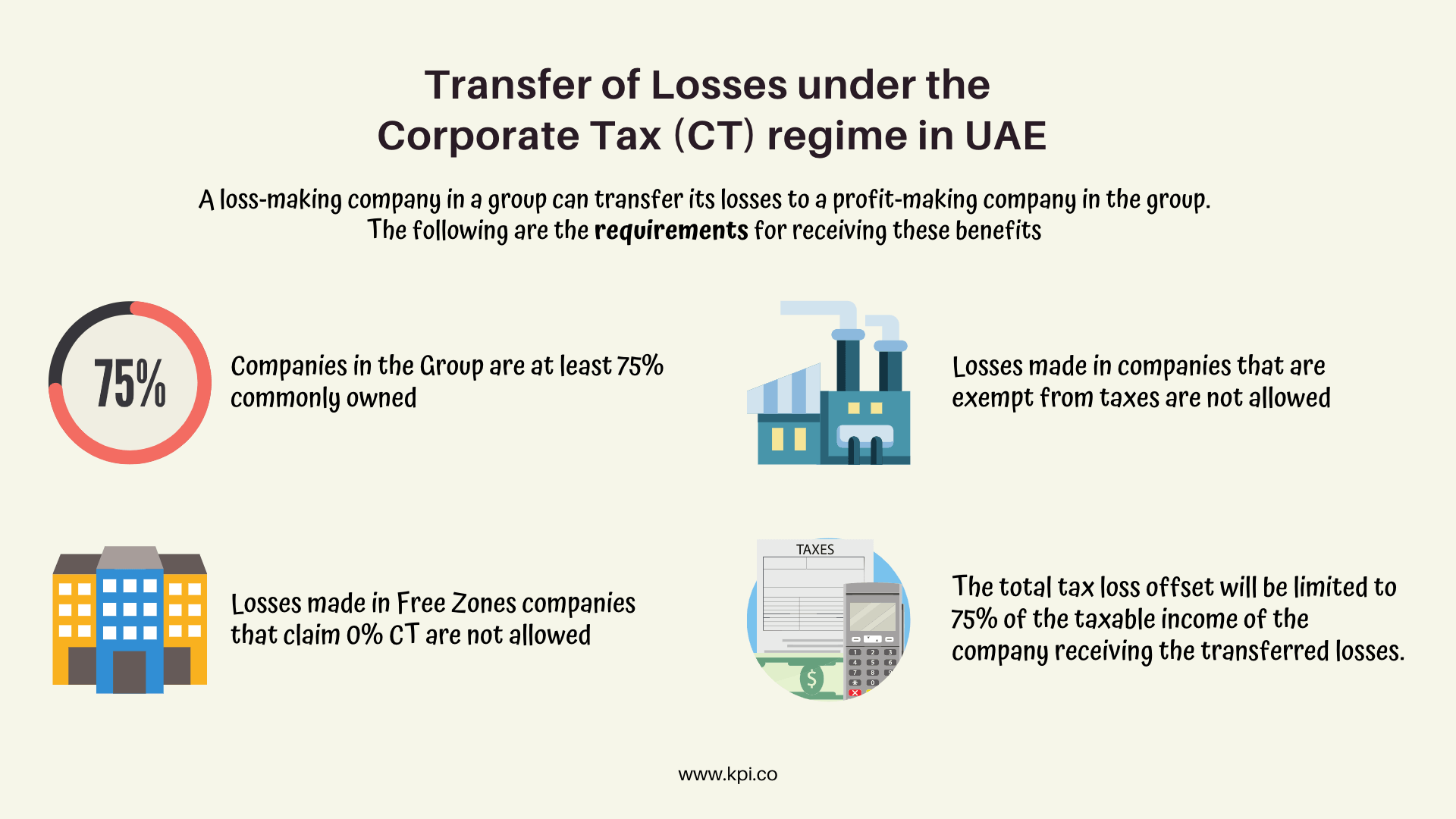

- 4. Transfer of Losses

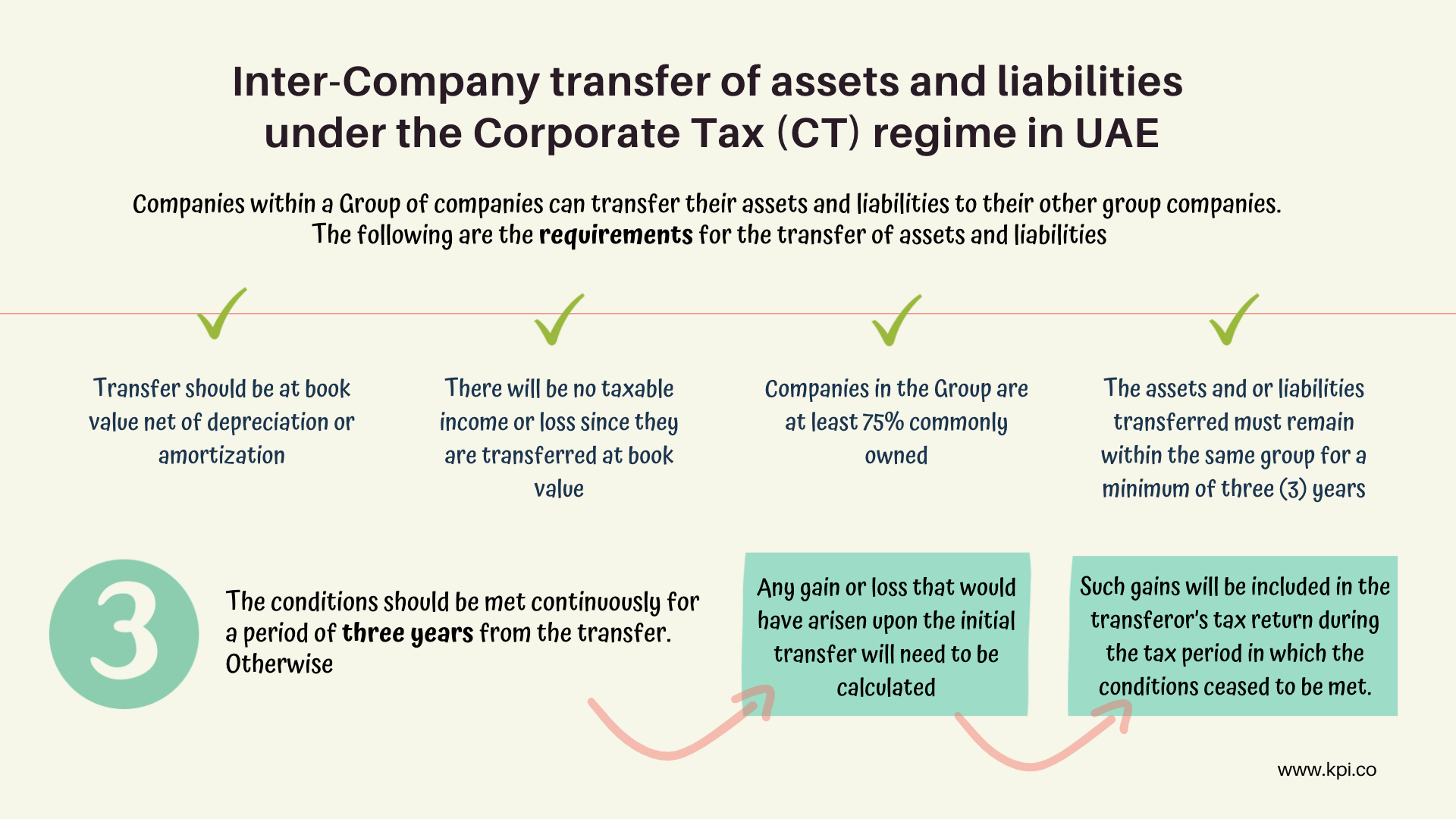

- 5. Inter-company transfer of assets and liabilities:

- 6. What are restructuring transactions?

- 7. How restructuring transactions are treated for UAE CT?

- The Wrap

How group companies are taxed? (UAE Tax Group)

Updated on : 28 May 2024

Published : 21 Jun 2022

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

The new Corporate Tax Law in UAE will be effective for financial years starting or after June 1, 2023.

The Corporate Tax Regime has been designed to incorporate best practices globally and minimize the compliance burden for UAE businesses.

Understanding Tax Groups

As an investor or business owner, you might have used different setups or structures to carry out your operations in UAE.

You might have set up one or more of the following:

- establish branches in different emirates.

- establish subsidiaries in different emirates. Many a time the subsidiaries may have a different set of partners.

- branch or subsidiaries in Free Zones. In most cases in Designated Free Zones – for supply chain and ease of operations.

The type of structure raises various issues in terms of taxation and compliance.

- What are the tax implications of these setups?

- What are the tax consequences of these arrangements?

- Does each branch/subsidiary file and pay its tax returns?

- Will the tax groups resemble the VAT groups that have been formed?

- What if some of the group companies are profitable while others are losing money?

- How will the taxability be affected?

- Will it raise the cost of compliance?

All such concerns and questions are addressed in the UAE CT regime. Let us find out.

1. Formation of Tax Groups

A UAE resident group of companies can elect to form a tax group and be treated as a single taxable person.

A tax group can be formed if the following conditions are fulfilled:

- parent company holds at least 95% of the share capital and voting rights of its subsidiaries.

- neither the parent company nor any of the subsidiaries can be an exempt person or a Free Zone Person that benefits from the 0% CT rate.

- all group members must use the same financial year

- consolidated group financial statements for the group should be submitted. Intercompany transactions should be eliminated.

2. How to form a Tax Group?

To form a tax group, the parent company and all the subsidiaries must submit a joint application to the FTA.

3. Who will be responsible for filing tax returns for the tax group?

Each member of the tax group will be jointly and severally liable for the group’s CT.

However, the FTA might approve one or more named members to be the representative member and responsible for the tax compliance for the tax group.

As you can see from the above, the 95% common equity among group companies is quite high. Many businesses may not be able to form the Group. In such cases, which are quite common, are there any alternatives?

In addition, there are many other challenges the group companies under common ownership face.

Some of them are:

- Companies formed in various emirates may have minority shareholders or even major nominee shareholders. These circumstances may make it impossible to form a Tax Group.

- Some of these businesses may be losing money. However, potentially contributing in some way to the other profitable companies in the group.

- In such circumstances, profit-making corporations may end up paying more taxes, even though expenses due to such earnings are not recorded in profit-making companies.

- Further, as the business environment changes the loss-making companies might have to be shut down. Assets disposed of. At a loss!

- Or the Assets or business units might be transferred to group companies. This may subject group firms to an unwarranted and unwelcome tax cost.

Is there a way to handle such challenges? How?

Fortunately, the answer is yes.

Reorganizing and restructuring businesses is common. And necessary for efficient operations. For good economics. For sustainable use of national resources.

UAE CT regime provides the following relief to group companies for organizing and restructuring their businesses.

- Transfer of losses

- Intra-group transfer of assets

- Restructuring relief

4. Transfer of Losses

A loss-making company in a group can transfer its losses to a profit-making company in the group.

The following are the requirements for receiving these benefits:

- companies in the Group are at least 75% commonly owned

- losses made in companies that are exempt from taxes are not allowed.

- losses made in Free Zones companies that claim 0% CT

- the total tax loss offset will be limited to 75% of the taxable income of the company receiving the transferred losses.

5. Inter-company transfer of assets and liabilities:

Companies within a Group of companies can transfer their assets and liabilities to their other group companies

The following are the requirements for the transfer of assets and liabilities:

- The transfer should be at book value net of depreciation or amortization.

- There will be no taxable income or loss since they are transferred at book value./li>

- Companies in the Group are at least 75% commonly owned.

- The assets and or liabilities transferred must remain within the same group for a minimum of three (3) years.

The conditions should be met continuously for a period of three years from the transfer. Otherwise,

- any gain or loss that would have arisen upon the initial transfer will need to be calculated.

- such gains will be included in the transferor’s tax return during the tax period in which the conditions ceased to be met.

6. What are restructuring transactions?

Any transaction that a company or its group companies undertakes to restructure its business operations is referred to as a restructuring transaction. Here are some examples of restructuring transactions:

- mergers and acquisitions

- demergers or spinoffs

- formation of a new company from out of the assets of a sole proprietorship or unincorporated business

- transfer or sale of whole or part of a business to another company

7. How restructuring transactions are treated for UAE CT?

- Assets and or liabilities transferred as part of a qualifying restructuring will be treated as being transferred at their tax net book value.

- Gain nor a loss on such transfer are not added to the taxable income.

if such assets or liabilities are transferred to a third party within three years of the restructuring,

- any gain or loss that would have arisen upon the initial transfer would be calculated.

- will be considered as taxable income in the year of transfer to a third party

The Wrap

After you've completed an analysis of your financial statements,

You should reconsider your company's ownership structure. Restructure it if necessary.

This is important for a variety of reasons. For the formation of tax groups. The transfer of assets and obligations, and the optimal management of cash flows. For many commercial activities, it is now possible to own 100% of the company in UAE. You could think about it.

The CT law would provide tax benefits for restructuring. With conditions.

LEAVE A REPLY

Related Topics

2 years ago

21 Jun 2022

KPI

Corporate Tax in UAE: Consultation document UAE Ministry of Finance

Have a say in how the UAE Corporate Tax laws should be - submit your comments and learn more about the new CT Law.

2 years ago

20 Jun 2022

KPI

UAE Corporate Tax Rates: How to Calculate your tax liability

Calculating your tax liability under the Corporate Tax Law.

2 years ago

22 Mar 2023

KPI

UAE Tax Residency Certificate: Cost and Simplified Guide

Secure your UAE tax residency certificate with our simple step-by-step guide. Get started today and stay compliant!

2 years ago

20 Jun 2022

KPI

Are companies in UAE Free Zones subject to Corporate taxes?

Find out how the UAE CT regime would honour tax incentives for Free Zone Persons.

2 years ago

21 Jun 2022

KPI

Corporate Tax: Loss carry forward - What, When and How much?

All the answers on Tax loss carry forward under the new Corporate Tax Law.

2 years ago

17 May 2023

KPI

Corporate Tax in the UAE: Can You Change Your Tax Period?

Can you change your tax period for the UAE Corporate Tax? What are the possible reasons for the change? How to align your financial year? Get the answers here!