- What is Ultimate Beneficial Ownership (UBO)?

- UAE Enhances Ultimate Beneficial Ownership (UBO) Regulations

- 2022 Latest Update: Ultimate Beneficial Owner

- Objectives of Ultimate Beneficial Owner (UBO)

- 9 things you must know about the Ultimate Beneficial Owner UAE

- 1. Applicability of Ultimate Beneficial Ownership

- 2. Exemptions of Ultimate Beneficial Ownership

- 3. Requirements for Ultimate Beneficial Ownership

- 4. Real Beneficiary

- 5. Contents of Register of Real Beneficiary

- 6. Contents of Register of Partners or Shareholders

- 7. Deadlines for the submission of Ultimate Beneficial Ownership (UBO)

- 8. Information Submission

- 9. Administrative Penalties Submission

- What does your business need to do to comply with UBO in UAE?

- Ultimate Beneficial Owner or UBO Compliance in UAE - Final Thoughts

- Simplify UBO registration and compliance with KPI

- How can KPI help?

- Ultimate Beneficial Owner (UBO) — FAQs

Ultimate Beneficial Owner (UBO) UAE - What you should know?

Updated on : 28 May 2024

Published : 16 Apr 2024

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

What is Ultimate Beneficial Ownership (UBO)?

The Ultimate Beneficial Owner (UBO) refers to the genuine beneficial owners, partners, and/or shareholders of an organization who owns or controls the legal entity or a natural person who conducts the transaction with the firm. The UBO may or may not be known as the owner of the business. As per the Cabinet Resolution, all companies incorporated in the UAE mainland and commercial free zones must keep track of their genuine beneficial owners, partners, and shareholders, according to the decision.

UAE Enhances Ultimate Beneficial Ownership (UBO) Regulations

The UAE has recently updated its Ultimate Beneficial Ownership (UBO) regulations through legislative updates. These updates apply to all UAE entities except for government-owned companies and those in financial-free zones. They include stricter disclosure requirements, the introduction of AML measures, and penalties for non-compliance, aiming to improve transparency, and identify UBOs within complex ownership structures. The amendments emphasize adherence to disclosure obligations, definition of beneficial owners, and grievance procedures while seeking expert guidance for compliance

2022 Latest Update: Ultimate Beneficial Owner

According to the Ministry of Economy, the deadline for providing data on ultimate beneficial owners (UBO) was June 30, 2022, or at the time of incorporation/registration of a new entity. The licensing authorities, however, are continuing to accept registrations. Many of the licensing authorities will require the information specified by the resolution when a company applies for trade license renewal or amendment.

Objectives of Ultimate Beneficial Owner (UBO)

Most countries around the world have legislation related to UBOs. The goal is to identify any illegal activities in the business. This is by money laundering, Know Your Customer (KYC), bribery, corruption, and terrorism financing legislation.

The government, regulatory authorities, and other firms interested in doing business with an entity can learn about it by identifying the UBO. Thus, the primary goal of UBO regulation requirements is to safeguard oneself from engaging in business with an entity that may be engaged in criminal activities. You have a thorough understanding of who your business partner or client is and what their company operations are, which is critical.

In line with the same, the UAE Cabinet released Cabinet Resolution No. 58 of 2020 on Regulation of Procedures Relating to Real Beneficiaries (“the Decision”) on August 28, 2020.

Also, in a series of legislative updates, the United Arab Emirates (UAE) has recently revised its Ultimate Beneficial Ownership (UBO) regulations and associated penalties. This development, including Cabinet Resolution No. 109 of 2023 and Cabinet Decision No. 132 of 2023, demonstrates a strong commitment to enhancing corporate transparency and aligning with international standards.

Also, check out our article on What is Reimbursement vs Disbursement as per UAE VAT Rules?

9 things you must know about the Ultimate Beneficial Owner UAE

Understanding the UBO regulation is essential for every company doing business in the UAE. The following are 9 crucial factors to remember under the UAE's UBO regulation:

1. Applicability of Ultimate Beneficial Ownership

All UAE-licensed businesses, both mainland and free zones.

2. Exemptions of Ultimate Beneficial Ownership

Companies licensed in ADGM & DIFC are exempt from this Decision since they already provide information to ADGM and DIFC concerning Real Beneficiaries/Ultimate Beneficial Owners.

Companies incorporated in the financial free zones of Abu Dhabi Global Markets (ADGM) and Dubai International Financial Centre (DIFC) may be subject to a different set of regulations.

Companies owned directly or indirectly by the government, whether federal or local, are excluded from this decision.

3. Requirements for Ultimate Beneficial Ownership

Create and maintain a Register of Real Beneficiaries and a Register of Partners or Shareholders.

For any changes in the details of beneficial owners, the legal person must be updated within 15 business days of the change coming into being.

4. Real Beneficiary

As per Financial Action Task Force (FATF), the 'Ultimate Beneficial Owner' is defined as "the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is executed".

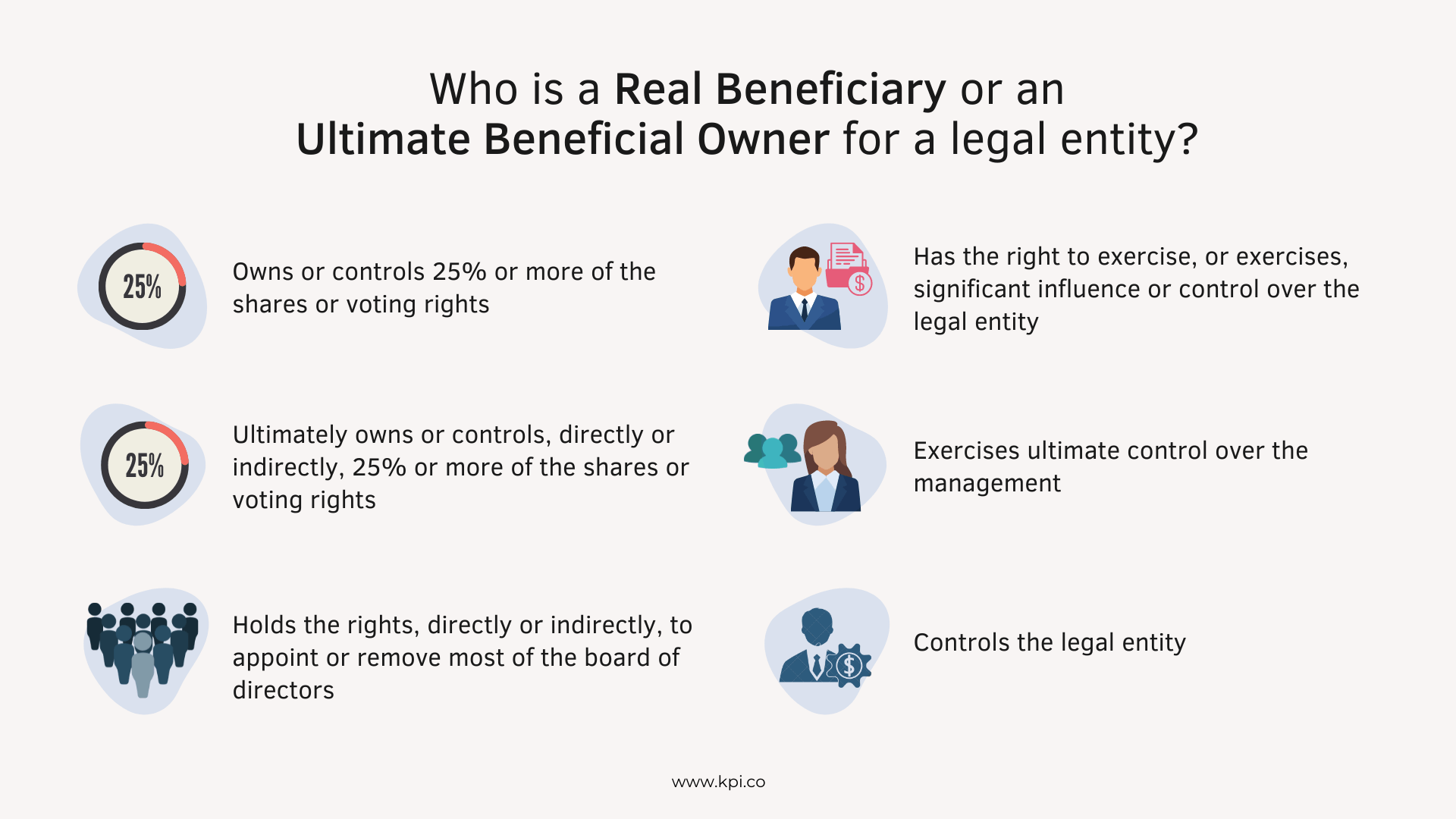

A legal entity's Real Beneficiary or Ultimate Beneficial Owner is someone who:

- Owns or controls 25% or more of the shares or voting rights;

- Ultimately owns or controls, directly or indirectly, 25% or more of the shares or voting rights;

- Holds the right, directly or indirectly, to appoint or remove most of the board of directors;

- Has the right to exercise, or exercises, significant influence or control over the legal entity;

- Exercises ultimate control over the management; or

- Controls the legal entity

Download the Declaration of the Beneficial Owner Form here

5. Contents of Register of Real Beneficiary

- Full name, nationality, date, and place of birth

- Place of residence or address (for correspondence under this Decision)

- Number of travel documents or ID cards, country and date of issue, and expiry date

- The basis on which he became a Real Beneficiary of the legal person and the date when he acquired such capacity

- The date on which the person ceased to be the Real Beneficiary

6. Contents of Register of Partners or Shareholders

- Full name, nationality, date, and place of birth

- Place of residence or address (for correspondence under this Decision)

- Number of travel documents or ID cards, country and date of issue, and expiry date

- Number of shares owned, category thereof, and the voting rights associated thereto

- Date of acquisition of capacity as Partner or Shareholder

- In case of a Partner or Shareholder is a legal person, Name, legal form and Memorandum of Association, Address of the main office, Name of senior management personnel (and all personal identification documents), and in case of a foreign shareholder or Partner, name and address of the legal representative in UAE

7. Deadlines for the submission of Ultimate Beneficial Ownership (UBO)

Register of Real Beneficiary and Register of Partners or Shareholders should be submitted to the respective Licensing Authority on or by 30 June 2022. The licensing authorities are still accepting registrations. When a company applies for renewal or amendment to its trade license, many of the licensing authorities will request information as specified in the Resolution.

In the event of any changes, these registers should be updated and should be notified to the respective Licensing Authority within 15 business days.

The respective licensing authorities are still accepting registrations.

8. Information Submission

A natural person residing in the UAE must be authorized by the legal person to carry the responsibility of disclosing the relevant details of the Registers to the Registrar. The legal person must supply the Registrar with the natural person's name, contact information, address, and a copy of his or her identity card or passport.

9. Administrative Penalties Submission

Failure to furnish the requested information to the Licensing Authorities could result in administrative penalties and sanctions. The Ministry of the Economy (MoE) has indicated that non-compliance with the UBO resolution will result in the application of administrative sanctions. The Dubai Economic Department's website has a copy of the resolution which lists all the administrative penalties against violators as per the provision of the UBO regulation. To view and download the list of files, click here. (Go to Page 4)

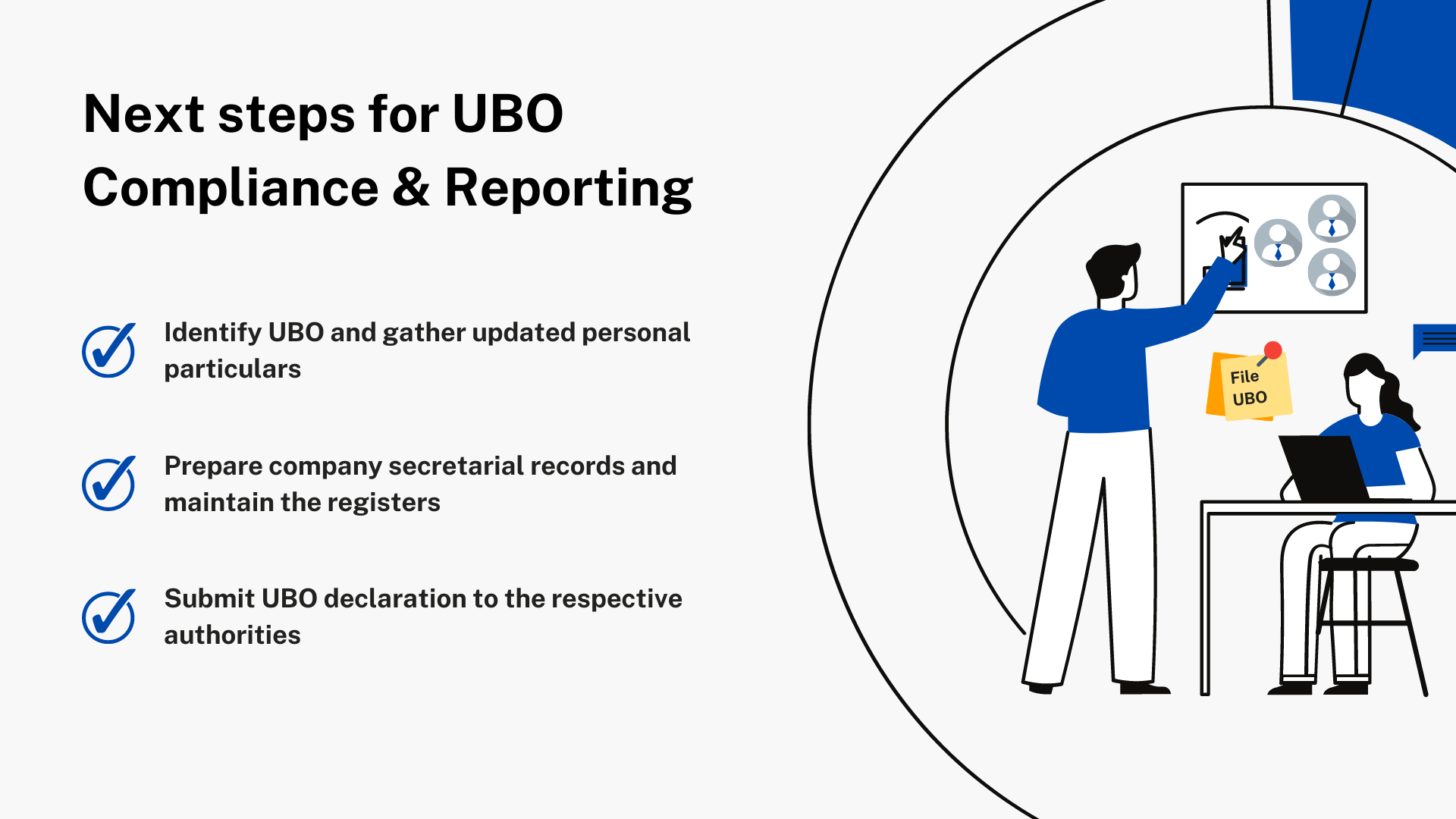

What does your business need to do to comply with UBO in UAE?

Obtain a UBO Certificate:

A UBO Certificate is awarded to an entity that successfully complies with UBO rules. The certificate verifies that the entity has validated its UBO and that it keeps track of its beneficial owners and other essential data.

Follow the right rules/procedure for UBO in UAE

At the time of onboarding or forming a new business connection, your company must follow procedures and processes to collect information about all individuals with substantial ownership or control.

Maintain accurate and up-to-date information:

Businesses should submit and maintain accurate and up-to-date information, as supplying inaccurate and misleading information will result in penalties. Aside from the charges, your organization may suffer a loss of reputation and client confidence.

Ultimate Beneficial Owner or UBO Compliance in UAE - Final Thoughts

The implementation of legislation such as the Ultimate Beneficial Ownership is a step forward for the UAE in the fight against money laundering and the financing of terrorism and illegal activities. This decision is also consistent with the UAE's commitment to the OECD's BEPS measures.

Various other legislation, such as Economic Substance Regulations, CbCR Reporting, and AML Regulations have been enacted by the government of UAE in recent quarters in order to increase transparency in business affairs. More transparency in the country's economic system is expected as businesses tighten their overall record-keeping and disclosures.

Simplify UBO registration and compliance with KPI

Our team can assist you with further advice and guidance on this regulation and development.

Contact us if you have any questions regarding:

-

Current Status Overview

-

Assistance in UBO Registration

-

Regular Review

-

Maintenance of the UBO register

-

UBO record maintenance

How can KPI help?

Our auditing firm, KPI UAE produces outstanding and distinctive audit reports, and we provide a wide range of professional auditing and accounting services to meet the needs of various business clients, including:

Ultimate Beneficial Owner (UBO) — FAQs

How to Identify Ultimate Beneficial Owner?

Identify the UBO by determining the entity’s ownership interest or management control including total number of shares, percentage ownership stake etc. with relevant documentation such as ownership structure, nominee agreements, etc.

What are the most effective ways to comply with UBO regulations?

-

Obtain a UBO Certificate

-

Maintain accurate / up-to-date records of beneficial owners of the company.

-

Establish procedures for regular monitoring and updating of UBO information.

-

Seek guidance from compliance professionals such as KPI

When is the regulation applicable and for whom?

The regulation applies to all UAE-licensed entities. The deadline to submit was on or before 30 June 2022. However, the authorities are still accepting registrations. Authorities need to be informed of any change in UBO within 15 days (about 2 weeks) from the change date.

What reporting needs to be done as per regulations?

As per the regulation, the company is required to maintain a Register of Real Beneficiaries and a Register of Partners or Shareholders.

Is UBO reporting made available in public domains?

The information is not made available in public domains. However, the information must be disclosed if required by relevant authorities.