Understanding UAE VAT Rules: Reimbursement vs Disbursement

Updated on : 13 Mar 2024

Published : 10 Mar 2024

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

Every day, your business spends a considerable amount of money on operational costs and customer expenses. When you pay something on behalf of a customer, you can either think of it as a disbursement or a reimbursement. They're both the same, right?

What do Reimbursement and Disbursement mean?

"Reimbursement" relates to the reimbursement of expenses incurred as a principal.

Whereas "Disbursement" refers to the reimbursement of payments made on another's behalf.

Let’s simplify these terms with some examples.

Example of Disbursement –

In a real-life scenario, let's consider a construction project where the main contractor hires a subcontractor to provide specialized equipment. Main contractor purchases the necessary equipment from various suppliers and is authorized by subcontractor to make the final payments. The suppliers issue invoices directly to the main contractor for the equipment supplied to subcontractor. Upon delivery of the equipment to the construction site, subcontractor reimburses main contractor for the expenses incurred in procuring the equipment on its behalf. These reimbursed expenses, referred to as disbursements, are exempt from Value Added Tax (VAT).

Example of Reimbursement –

Imagine a consulting engagement where Company X hires Company Y, an auditing firm, to conduct financial audits. As part of the audit process, Company Y's auditors travel to various locations, incurring travel expenses. According to the terms of their agreement, Company X is responsible for reimbursing Company Y for these travel expenses. In this context, the reimbursement of travel expenses by Company X to Company Y is considered part of the main VAT supply and qualifies as a reimbursement.

Reimbursement and reimbursement procedures are typical whether your company deals with consignments, agencies, or third-party service arrangements. When such transactions arise, it is critical to understand their VAT treatments to ensure correct accounting and reporting according to the region's regulatory requirements. Payments comprising multiple layers of business relationships via contracts might make it difficult to calculate the VAT impact. The FTA issued a public clarification statement detailing the VAT impact on disbursements and reimbursements to make it easier to grasp the linked VAT laws.

As a service provider or agent, when you make payments on behalf of your client and subsequently bill them to recover these expenses, there are two types of expense recovery procedures:

- reimbursement, and

- disbursement

The VAT treatment will be determined by whether the expense recovery is a Reimbursement or a Disbursement.

Let's delve deeper into these rules to gain a clearer understanding of their implications for VAT in the UAE.

How to Assess Reimbursements vs Disbursements per UAE VAT?

The UAE Federal Tax Authority has issued an explanation document known as VATP013. The document outlines the rules for reimbursements and disbursements. And the associated VAT liabilities.

The principles of Reimbursement are:

- Contract for the supply of goods or services should be in your name and capacity;

- Goods or services received by you from the supplier;

- Ownership of the goods should be with you before making the onward supply to the other party;

- The supplier invoice should be in your name and you are under the legal obligation to pay for it

The principles of Disbursement are:

- The recipient of goods or services should be the other party;

- The responsibility to pay for the goods or services shall be of another party;

- The invoice or tax invoice should be in the name of the other party;

- The other party should authorize you to pay on his behalf;

- The payments to the supplier should be separately shown on your invoice and should recover the exact amount paid to the supplier;

- The goods or services paid for should be added to the supplies you make to the other party

The principles outlined above dictate whether your expenditures or payments are eligible for reimbursement. You must consider all relevant information and circumstances.

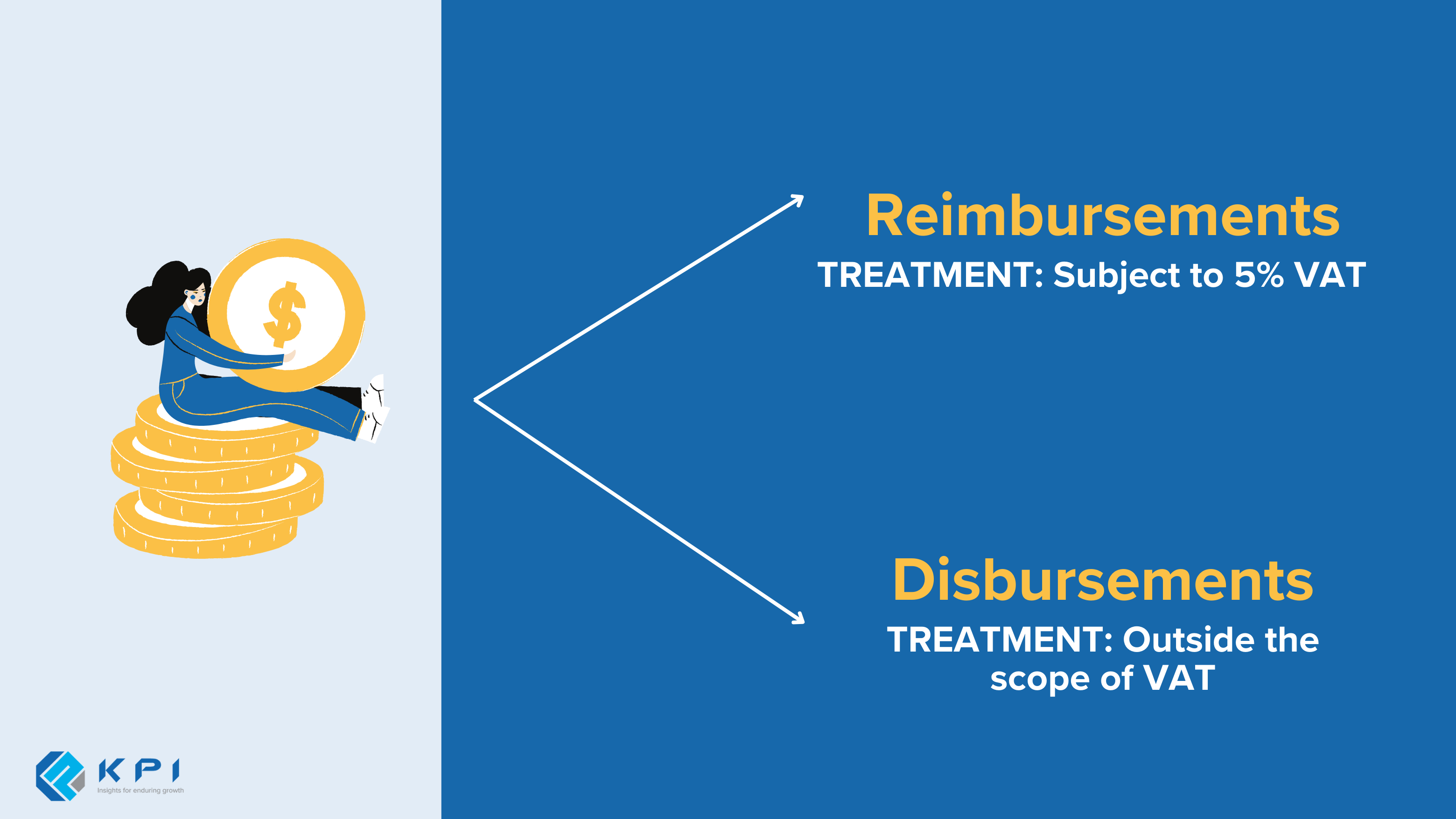

Treatment of Reimbursement and Disbursement Expenses

Think about it this way. Reimbursement of expenses is subject to VAT since it is part of the consideration for the supply. However, the disbursement of expenses does not constitute a supply and is not subject to VAT.

When selling goods or services, your business incurs various costs and expenses. Following internal auditing, these expenditures are categorized as the cost of goods or services. The recovery of these costs constitutes reimbursement, and VAT is applicable to the reimbursed amount.

Let us assess this with some examples.

What are Reimbursable Expenses?

Imagine a customer hiring a consulting firm for a feasibility study report. The contract states that some out-of-pocket costs, such as travel, lodging, and meals, will be covered, meaning the consulting firm must pay for these costs.

These costs are added to the customer's bill as "out-of-pocket expenses," as per the outlined contract; with no markup. The reimbursement of such expenses would be subject to the same VAT treatment as the main supply and will consequently be subject to VAT.

In this context, the costs incurred by the consulting firm are incidental to supplying services, making them reimbursable and subject to VAT.

What are Disbursable Expenses?

Here is an example of when the subsequent recovery of the price paid towards the license renewal will be considered a Disbursement, making it exempt from VAT.

A consultancy firm renews a customer’s trade license and pays the license and other fees to the licensing authority on behalf of its customer. This is because the consultant firm served as the customer's representative or agent in renewing the license. The firm recovers the amount paid as a fee, with no markup.

This scenario is considered a disbursement because the consultancy firm is essentially making a payment on behalf of the customer and recovering only the actual amount spent, without any additional cost. In such cases, the subsequent recovery of the amount paid towards the license renewal is considered a disbursement and is generally exempt from VAT.

How to comply with UAE VAT laws for Disbursements?

- Assess your business transactions with Vendors and Customers

- Consult tax advisors to assess how you recharge your costs to your customers

- Discuss with your Vendors and customers and amend the contracts/ agreements

- Treat reimbursable expenses as taxable

- Treat only disbursable expenses as exempt from tax

How can KPI help?

Our auditing firm, KPI UAE produces outstanding and distinctive audit reports, and we provide a wide range of professional auditing and accounting services to meet the needs of various business clients, including:

- Corporate Tax Services

- UAE VAT Advisory

- Economic Substance Regulation

- Financial Statement Audit

- Non-audit Services

- Liquidation & Deregistration

- Business Set-up Services

- Merger & Acquisition Advisory

Reimbursements and Disbursements - FAQs

Why is it important to understand the difference between reimbursements and disbursements in VAT reporting?

Reimbursements and disbursements have different treatment under VAT reporting in the UAE. Reimbursements would be considered as part of the main supply and would therefore have VAT implications. However, disbursements would be considered out of the scope of VAT.

How does the ownership of goods impact the principles of reimbursement?

Ownership of goods helps to identify whether a transaction is considered a reimbursement or disbursement. If the goods are received from the supplier to you directly, the transaction may be considered as reimbursement for VAT purposes.

Can a reimbursable expense ever be exempt from VAT in the UAE?

A reimbursable expense can potentially be exempt from VAT if the expense falls under the VAT Exempt supplies criteria under the VAT Decree Law which includes items such as certain financial services, residential properties, and local passenger transport, etc.

What steps should businesses take to comply with UAE VAT laws for disbursements?

To comply with the UAE VAT laws for disbursements, the following steps should be taken:

-

The expense needs to be identified and documented appropriately. This includes maintaining all the relevant documentation such as invoices, receipts etc.

-

The VAT Treatment of the expense must be identified to know if it is standard-rated, zero-rated, exempt, or out of scope.

-

Review contracts and agreements with suppliers, customers, and other parties to ensure the VAT implications regarding disbursements are appropriately addressed.

-

Consult tax advisors to assess how you recharge your costs to customers.

Are there specific industries where disbursement is more common than reimbursement?

Certain industries such as Consulting, Legal services, advertising/marketing agencies, and more, usually have a higher prevalence of disbursement than reimbursement since these industries typically operate on a model where expenses are integrated into the overall service fees rather than reimbursed separately.

LEAVE A REPLY

Related Topics

2 years ago

27 Oct 2024

KPI

Zero-Rating Export Services in the UAE: A 2024 VAT Guide

Learn what are the conditions and what businesses need to do to avail of zero-rated VAT on the export of services.