Taxability of Free Zone in the UAE: Key Takeaways

Introduction

Let’s take a moment to discuss the taxability of a Qualifying Free Zone Person. The UAE Corporate Tax law is covered in 20 chapters. There are about 70 articles in total and these articles are divided into various clauses and paragraphs for better understanding of the Corporate Tax Law. Further, various Cabinet Decisions and Ministerial Decisions including guidance notes have been issued to give clarity on certain provisions of the Corporate Tax Law

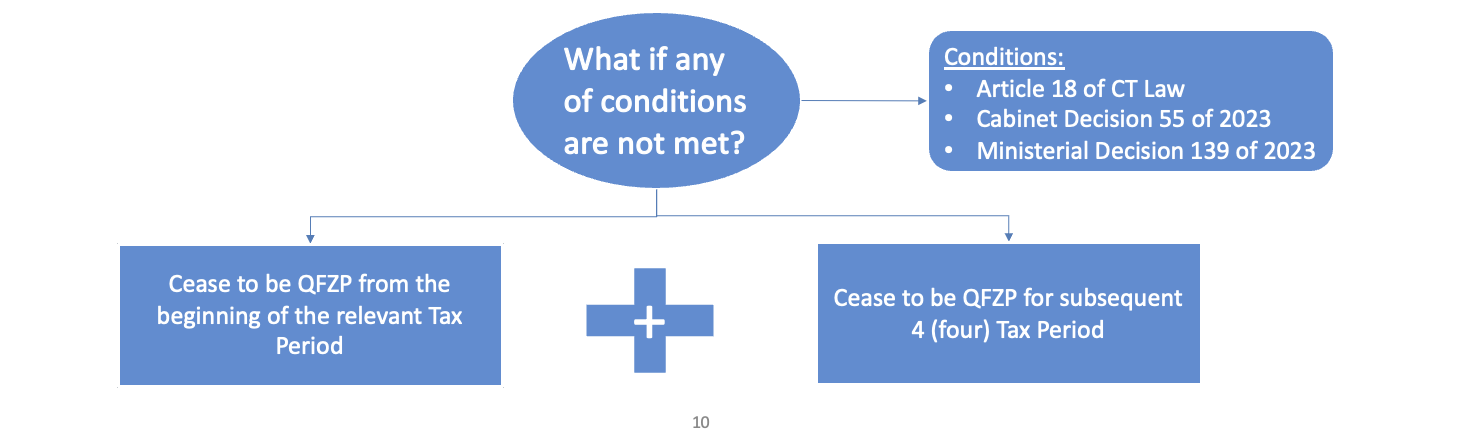

The webinar broadly covers the following Articles, Cabinet Decisions and Ministerial Decisions which are relevant to Taxation of a Qualifying Free Zone Person:

- Article 18 of Federal Decree Law No. 47 of 2022

- Cabinet Decision No. 55 of 2023

- Ministerial Decision No. 139 of 2023

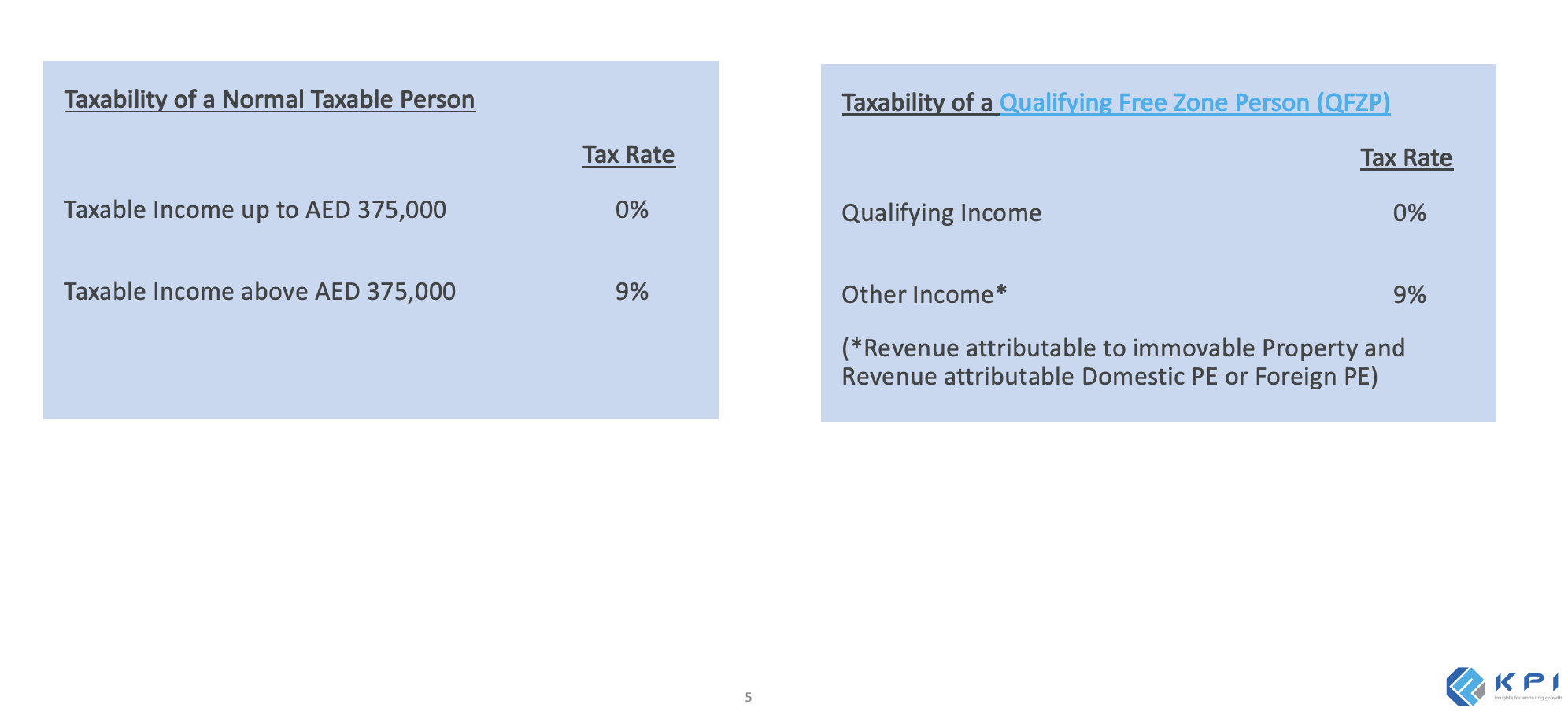

Corporate Tax Rates Applicable to Normal Taxable Person vs Qualifying Free Zone Person

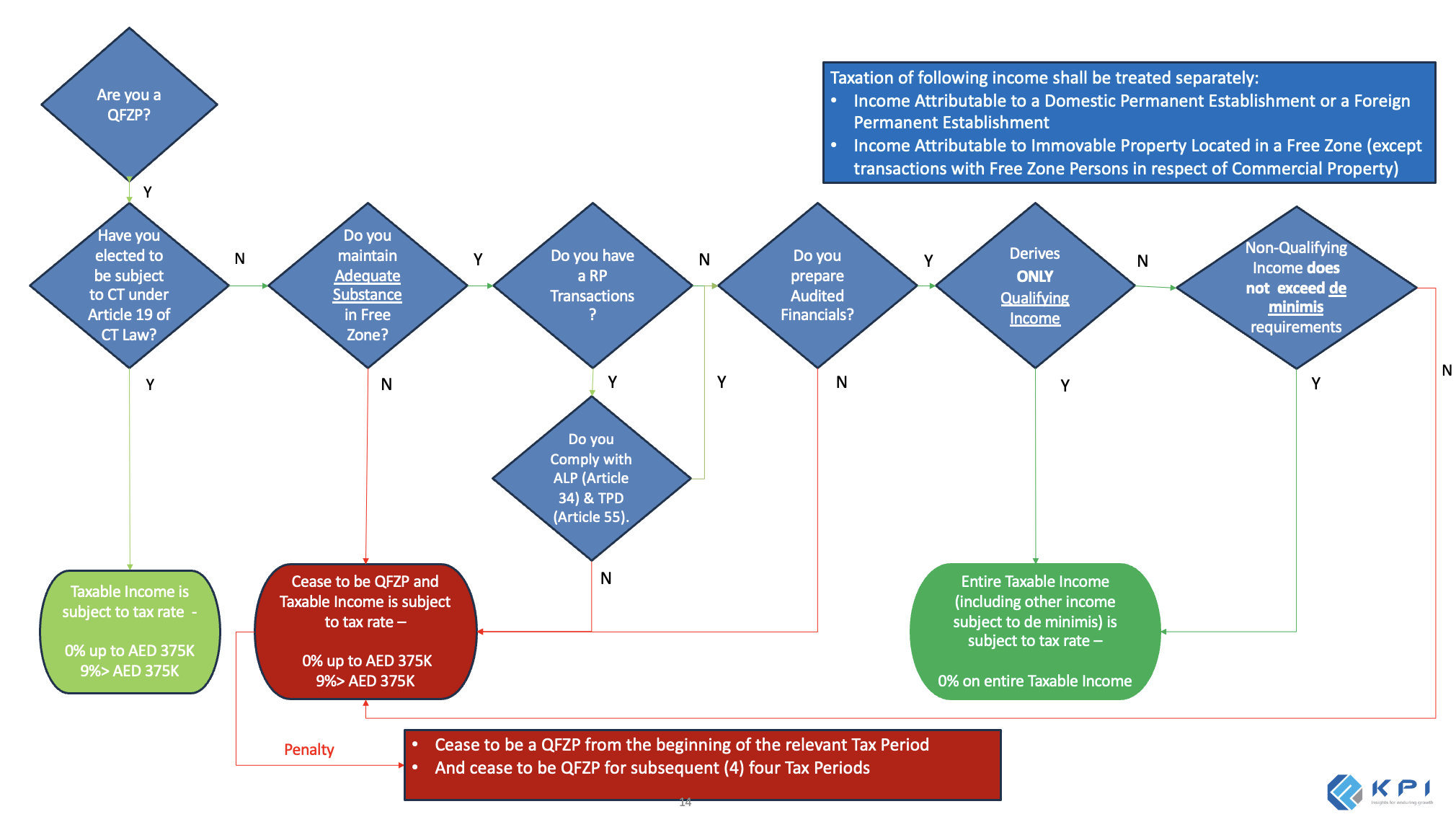

What are the conditions to be a Qualifying Free Zone Person (QFZP)?

- Maintains adequate substance in the State.

- Derives Qualifying Income as specified in a decision issued by the Cabinet at the suggestion of the Minister.

- Has not elected to be subject to Corporate Tax under Article 19 of this Decree-Law.

- Complies with Article 34 and 55 of this Decree Law.

- Meets any other conditions as may be prescribed by the Minister. other conditions as per Article (5) Clause (1) of Ministerial Decision No. 139 of 2023

- Its non-qualifying Revenue does not exceed the de minimis requirements set out in Article (4) of Ministerial Decision No. 139 of 2023.

- It prepares audited financial statements in accordance with any decision issued by the Minister on the requirements to prepare and maintain audited financial statements for the purposes of the Corporate Tax Law.

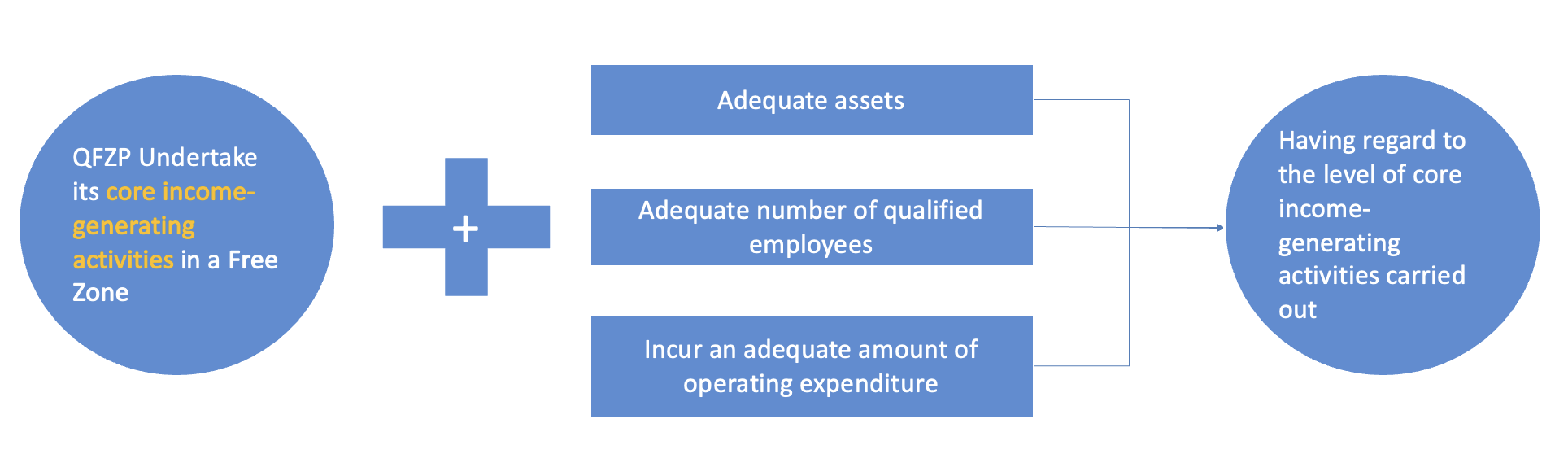

What is Adequate Substance?

Maintaining Adequate Substance in a Free Zone and Outsourcing

(Article (7) of Cabinet Decision No. 55 of 2023)

Activities can be outsourced to a Related Party or third party in a Free Zone provided QFZP has adequate supervision over outsourced activities

The term “Adequate” is not defined in the Law, however it should be commensurate to the size of the business.

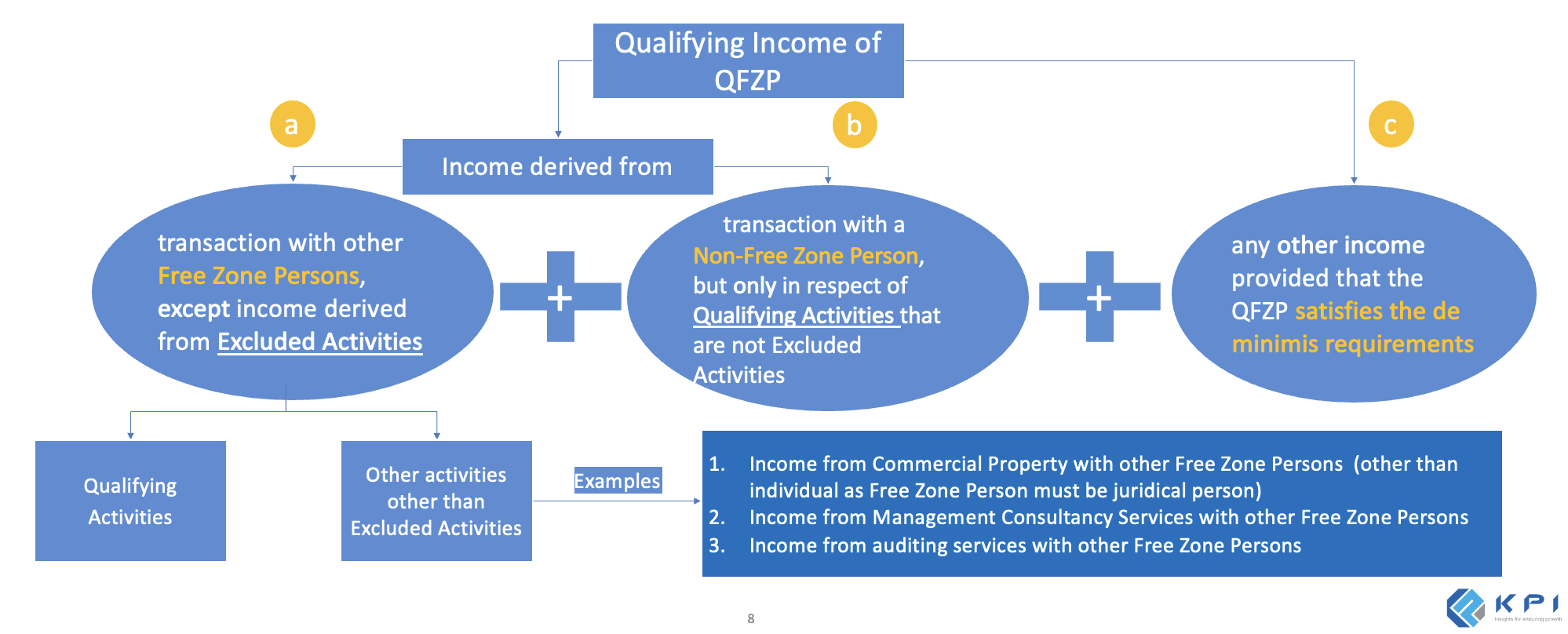

What is Qualifying Income?

Qualifying Income of the Qualifying Free Zone Person (QFZP) shall include the below categories of income

(Clause (1) of Article (3) of Cabinet Decision No. 55 of 2023)

Not Elected to be Subject to Corporate Tax at Normal Tax Rate

Qualifying Free Zone Person can make an election to be subject to Corporate Tax at the rates specified under Clause 1 of Article 3 of Corporate Tax

(Clause 1 of Article 19 of Federal Decree Law No. 47 of 2022)

The election under clause 1 shall be effective from either of:

- a. The commencement of the Tax Period in which the election is made

- b. The commencement of the Tax Period following the Tax Period in which the election was made

What are the Other Conditions?

Qualifying Free Zone Person must meet the following two conditions:

(Clause 1 of Article (5) of Ministerial Decision No. 139 of 2023)

In addition to the conditions set out in Clause (1) of Article (18) of the Corporate Tax Law, a Qualifying Free Zone Person must meet the following two conditions:

- a. Its non-qualifying Revenue does not exceed the de minimis requirements set out in Article (4) of this Decision.

- b. It prepares audited financial statements in accordance with any decision issued by the Minister on the requirements to prepare and maintain audited financial statements for the purposes of the Corporate Tax Law

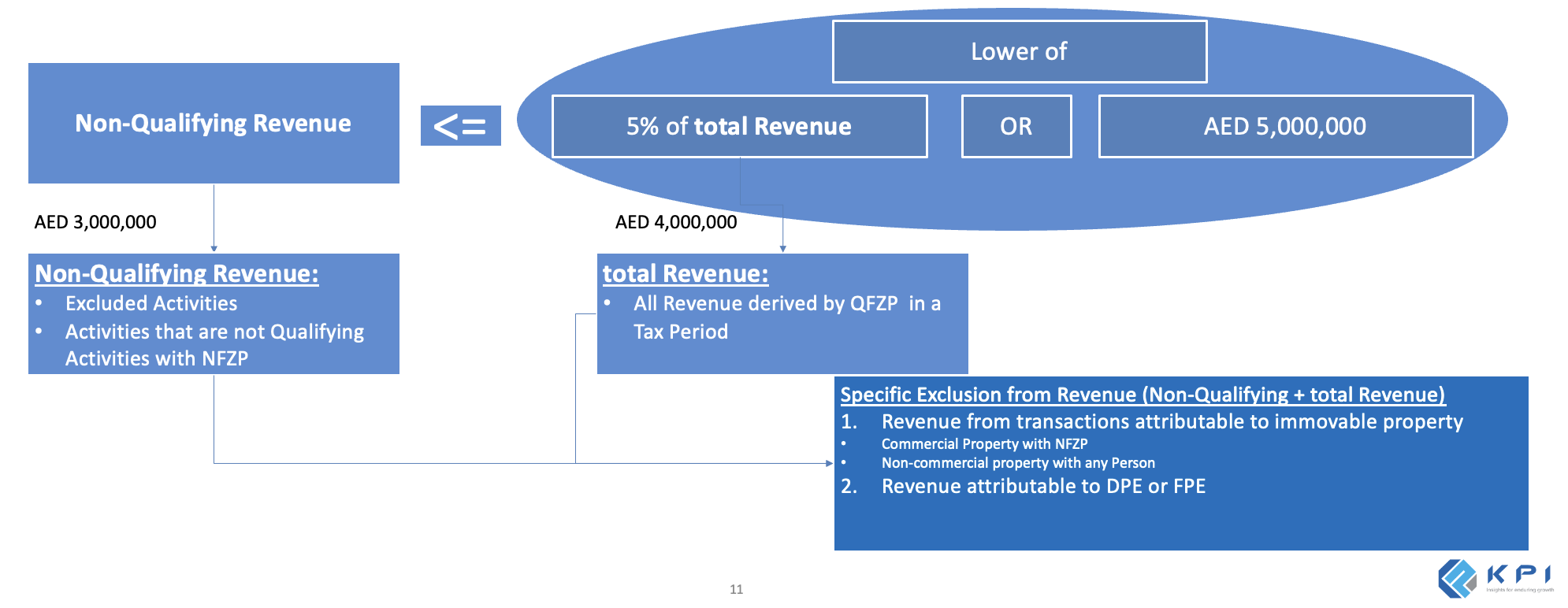

What is De Minimis Requirements?

As a Free Zone Person, why is it important to know the De Minimis Requirements?

This basically talks about the Non-Qualifying Revenue should not exceed the lower of 5% of the total Revenue or AED 5,000,000.

What are Excluded Activities in the UAE?

As per Clause (1) of Article (3) of Ministerial Decision No. 139 of 2023, for the purposes of Cabinet Decision No. 55 of 2023, following activities shall be considered as Excluded Activities:

- a. Any transactions with natural persons, except transactions in relation to Qualifying Activities specified under paragraphs (d), (f), (g) and (j) of Clause (1) of Article (2) of this Decision :

- (d) Ownership, management and operations of Ships.

- (f) Fund management services*

- (g) Wealth and investment management services*

- (j) Financing and leasing of Aircraft, including engines and rotable components

- b. Banking activities*

- c. Insurance activities*,other than the activity specified under paragraph (e) of Clause (1) of Article (2) of this Decision

- (e) Reinsurance Services*

- d. Finance and leasing activities*, other than those specified under paragraphs (i) and (j) of Clause (1) of Article (2) of this Decision.

- (i) Treasury and financing services to Related Parties

- (j) Financing and leasing of Aircraft, including engines and rotable components

- e. Ownership or exploitation of immovable property, other than Commercial Property located in a Free Zone where the transaction in respect of such Commercial Property is conducted with other Free Zone Persons.

- f. Ownership or exploitation of intellectual property assets

- g. Any activities that are ancillary to the activities listed in paragraphs (a) to (f) of this Clause

*subject to the regulatory oversight of the competent authority in the State

What are Qualifying Activities in the UAE?

- a. Manufacturing of goods or materials.

- b. Processing of goods or materials

- c. Holding of shares and other securities.

- d. Ownership, management and operation of Ships.

- e. Reinsurance services*

- f. Fund management services *

- g. Wealth and investment management services *

- h. Headquarter services to Related Parties.

- i. Treasury and financing services to Related Parties.

- j. Financing and leasing of Aircraft, including engines and rotable components.

- k. Distribution of Goods or materials imported in or from a Designated Zone to a customer for the purposes of sale or resale.

- l. Logistics services.

- m. Any activities that are ancillary to the activities listed in paragraphs (a) to (l) of this Clause

*subject to the regulatory oversight of the competent authority in the State

Summary of QFZP Taxability

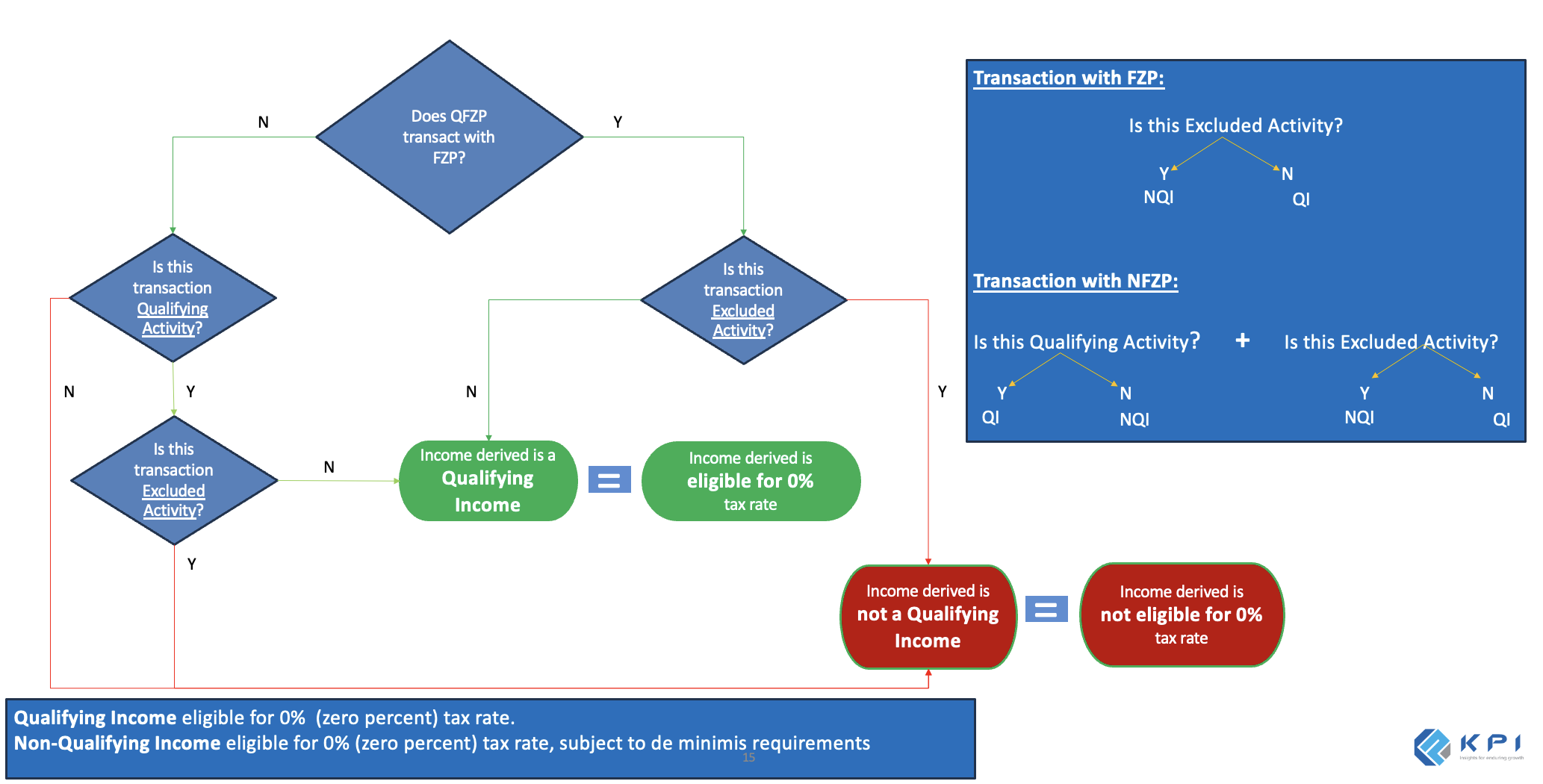

How to Determine Qualifying Income and Not a Qualifying Income?

Get the Right Guidance

Send Inquiry

Speak to Our Team