Submitting the Economic Substance Annual Report in UAE

Updated on : 14 Jun 2022

Published : 14 Jun 2022

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

The UAE Economic Substance Regulations (ESR) went into effect on April 30, 2019. Following that, as per Ministerial Decision No. 215 of 2019, guidance on the application of these regulations was also introduced. According to the regulations, enterprises established in the UAE that engage in the activities listed in the guidance must demonstrate adequate economic presence by passing the UAE economic substance test. Companies must inform and file an annual UAE economic substance report to regulatory authorities if they are carrying out the required operations, according to the legislation.

Every year, businesses must submit an annual report to the Regulatory Authority to demonstrate that they are engaging in the relevant activity. Details of the activity, income, expenses, and assets must be provided to determine whether the UAE economic substance test is passed. Companies must submit their annual reports to the Authority within 12 months of the financial year's close.

Let's look at a few important aspects related to annual reporting requirements under the Economic Substance Regulations in UAE.

Who is required to submit the Economic Substance Annual Reports?

The Annual Report must be submitted on or before the prescribed due date by a licensee who engages in a Relevant Activity and generates Relevant Income from that Relevant Activity during the relevant financial year. If a Licensee engages in a Relevant Activity but does not generate Relevant Income, the Annual Report for the relevant financial year is not required. The Economic Substance Test for the corresponding financial year is likewise waived for such Licensees. It will, however, be necessary to file a Notification with the relevant authority.

Contents of the Economic Substance Annual Report

Article 8 of the Regulation deals with the contents of the Economic Substance Notification and Annual Report.

The content of the Economic Substance Annual Report with respect to a Relevant Activity carried out in the UAE by a licensee is as follows:

- Type of relevant activity conducted

- Amount and type of relevant income in respect of the relevant activity

- Amount and type of operating expenses and assets with respect to the relevant activity

- Location of the place of business, plant, property, or equipment used for the relevant activity

- Number of full-time employees with qualifications and the number of personnel who are responsible for carrying out the Licensee’s relevant activity

- Information on the core income-generating activity in respect of the relevant activity

- Financial statements of the licensee

- A declaration of whether or not the Licensee satisfies the Economic Substance Test

- In the case of intellectual business, a declaration as to whether or not it is a high-risk intellectual property business together with certain additional information

- Details of the outsourced processes/activities, if any, together with certain additional information to ensure it meets with the Economic Substance Test

A licensee may be required to produce extra information, documents, or records as requested by the Competent Authority to ensure compliance with the Economic Substance Regulation

In addition, a licensee may be required to produce information and documentation on the agenda, minutes, and attendance of board meetings held during the relevant financial year. This is necessary in order to comply with the managed test.

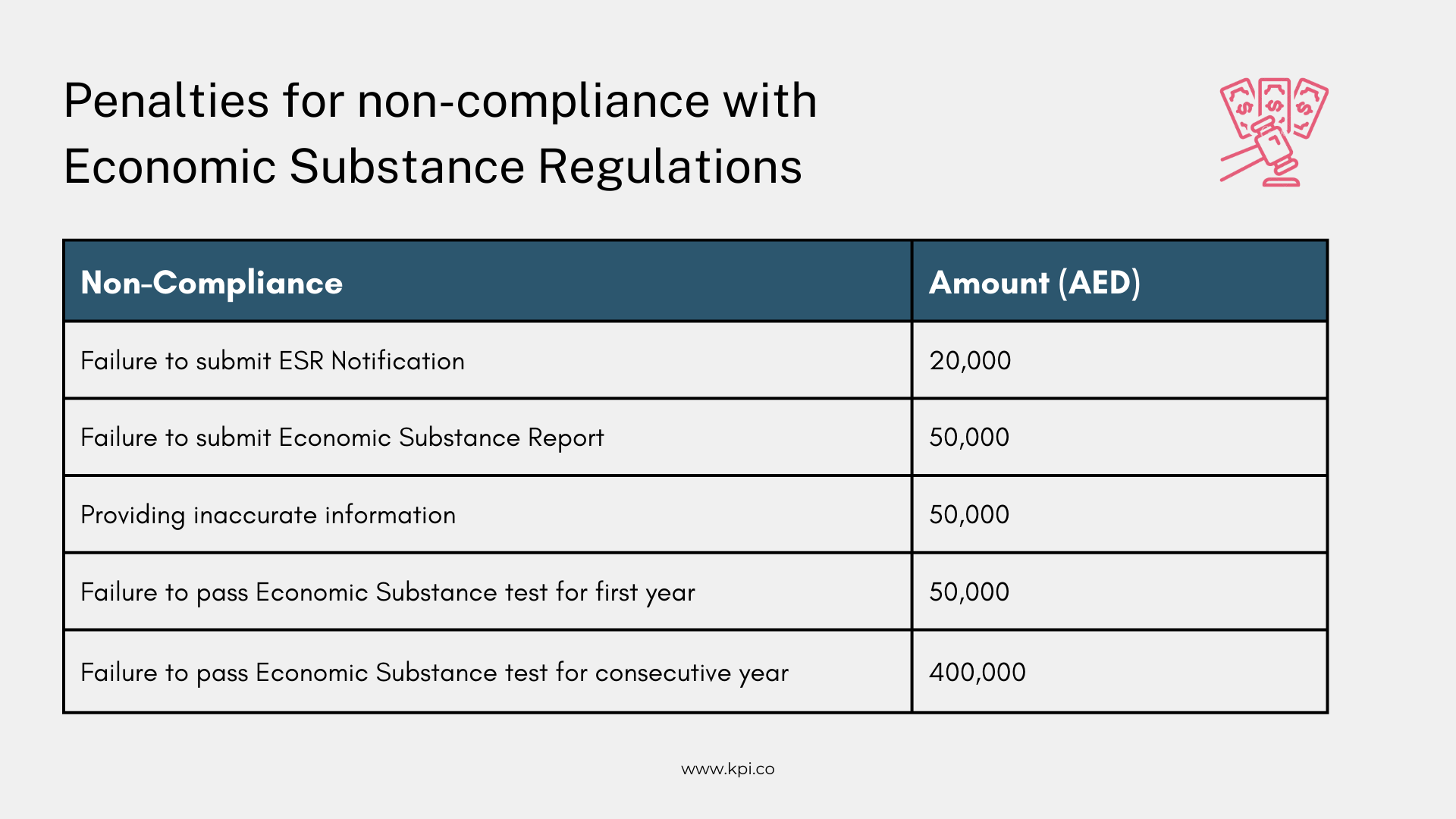

Penalties for failing to comply

Penalties are in place and will be applied if relevant entities fail to comply with the ESR reporting requirements. The penalties are up to 50,000 AED for the first financial period and up to 400,000 AED in subsequent financial periods.

Businesses must begin collating and capturing information in a precise manner, well ahead of time to avoid a last-minute rush that will inevitably coincide with the end of the fiscal year.

For more on ESR in UAE, check out the following articles:

- Demonstrating Substance under Economic Substance Regulations

- Impact of Economic Substance Regulations on key business activities

At KPI, our advisory experts assist customers with Economic substance Regulation compliance, assessment, and reporting. If you have any questions related to ESR, please leave a comment below or contact us.

LEAVE A REPLY

Related Topics

1 day ago

26 Feb 2026

KPI

e-Invoicing in the UAE: How to Prepare for the 2026–2027 Phased Rollout

A practical guide to UAE e-invoicing timelines, compliance rules and preparation steps for businesses