NetSuite VS QuickBooks – Which accounting software is better?

Updated on : 30 May 2024

Published : 03 Jun 2022

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

Should I invest in NetSuite or QuickBooks to manage my company's accounting and finances?

If you are reading this, you have probably been asking yourself this question for some time or thinking about it right now.

You may be a business owner, A CFO, or a finance manager debating whether to invest in a full-fledged ERP or stay with QuickBooks for accounting.

You will need answers to this question. You need it sooner! We want to assist you in finding the answers.

In this comparison guide, we'll look at the features of both applications and compare them. Then we go over the two most important factors that we believe will influence your decision: time and money.

Our objective is that you have enough information by the end of the article to confidently pick which accounting software is best for your business.

Are we ready to go?

Great, let’s get the facts out.

Every business starts small

Every company begins small. Businesses face a variety of challenges throughout their initial few years of operation. Some are more difficult to overcome than others. Many firms have seen unanticipated ups and downs in the last 2-to 3 years.

In any challenging situation, the last thing your company would like to face is accounting gaps and errors caused by inefficient systems. Owing to the laborious nature of bookkeeping, many businesses still struggle to keep track of their accounts. Things become more complex as your company grows in size! Add to that - more clients, more employees...

Reliable and scalable accounting software is the only way to assure your accounting and finance are on track.

NetSuite and QuickBooks

NetSuite ERP and QuickBooks Online are built for the same purpose. Both are designed to manage and optimize your financial activities. The breadth of their functionality differs significantly.

NetSuite is a comprehensive and integrated suite of business management tools that includes full-featured accounting, HR, Finance, Operations, and Inventory. All in one single system. You do not need to maintain several systems.

QuickBooks, on the other hand, is a more straightforward accounting tool that handles fundamental accounting tasks like invoicing, mileage tracking, and payroll.

NetSuite and QuickBooks are both popular accounting software systems. But, they have distinct features.

Let's understand this further.

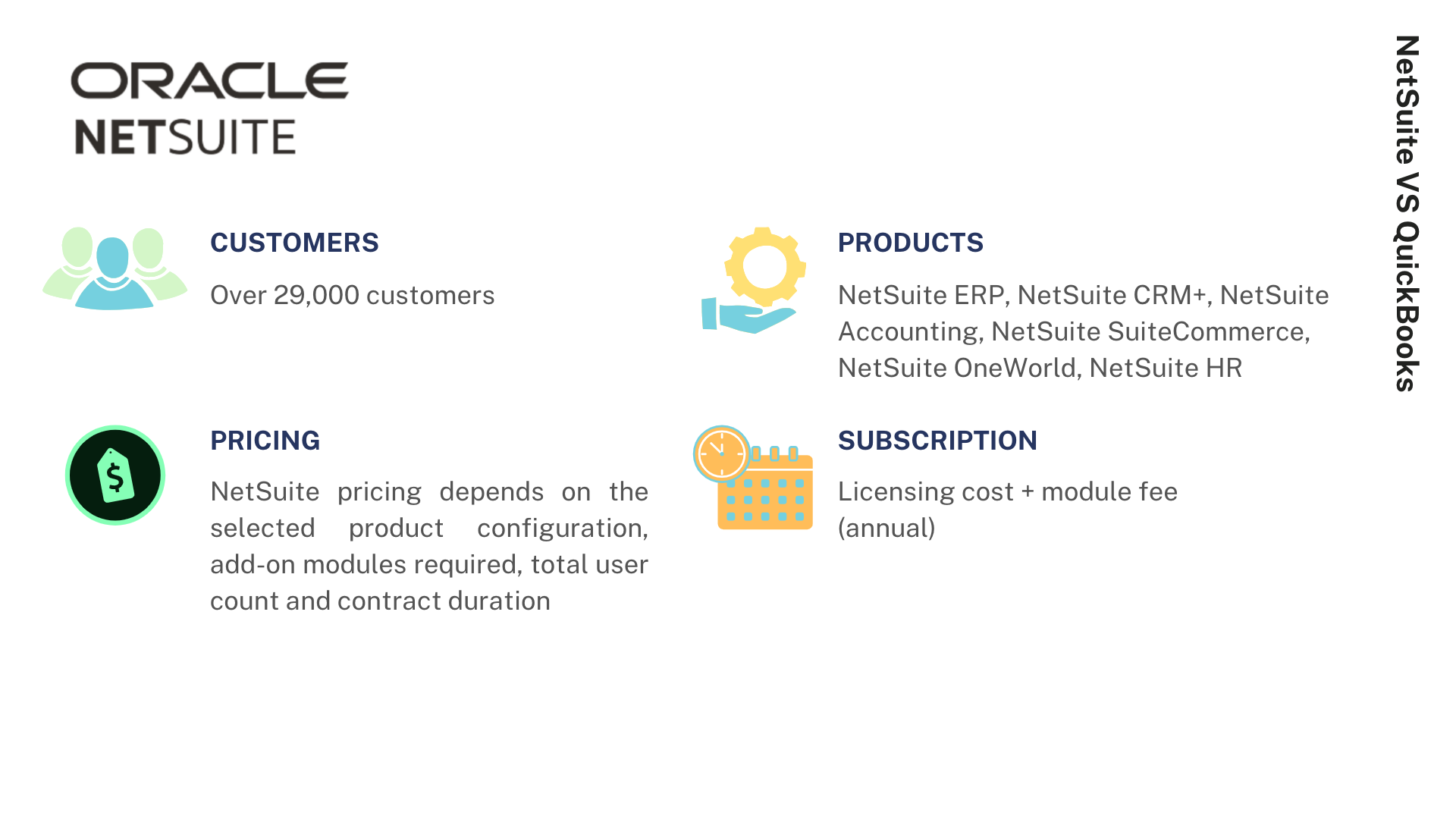

Oracle NetSuite

NetSuite Inc. is a cloud computing firm. Since 1998, NetSuite provides software as a service to help businesses manage their finances, operations, and customer relationships. Its ERP, CRM, PSA, inventory/warehouse management, and e-commerce software and services are geared toward small and medium-sized businesses and are used by more than 29,000 customers in 215 countries and territories. NetSuite was bought by Oracle Corporation in 2016.

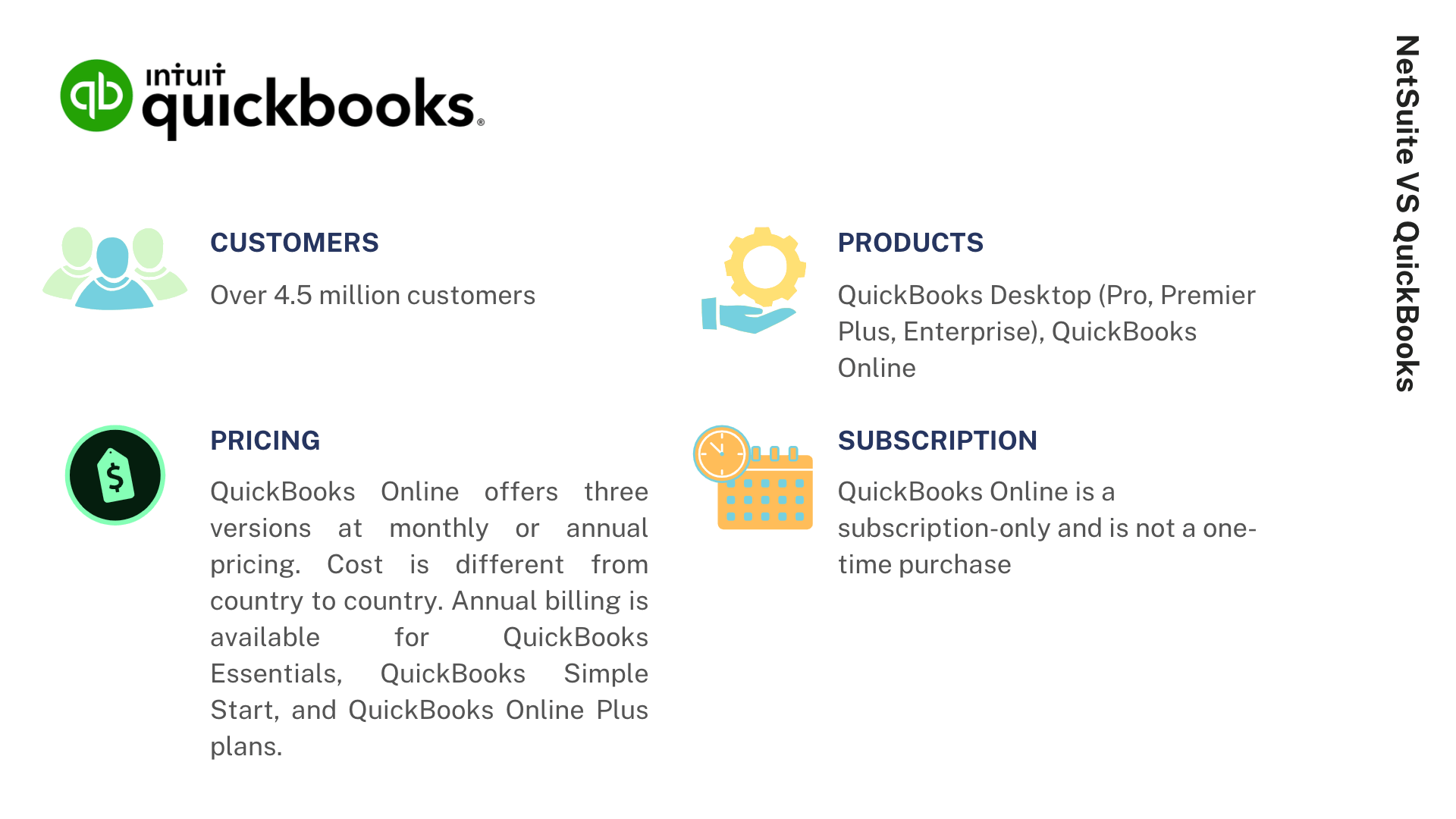

QuickBooks

Intuit developed and markets QuickBooks, an accounting software program. QuickBooks products were first developed in 1983 and are primarily targeted at small and medium-sized businesses.

Key features of comparison between NetSuite vs QuickBooks

Here's a rundown of how key NetSuite and Quickbooks capabilities stack up against each other:

1. Revenue Recognition

Revenue recognition can get complicated at times. Depending on the transactions that generate revenue. IFRS Requirements need to be met. The schedules must match the length of the period over which the revenue is to be booked. Proper income accounts are to be credited.

NetSuite has a separate module that can be set up to meet any complex revenue recognition criteria. It allows accounting for revenue recognition automatically. GL accounts are up-to-date with accurate details.

With QuickBooks, for revenue recognition, you need to rely on workarounds. The workarounds inevitably result in a tangle of manual journal entries. Complicated recognition schedules, spreadsheets, and a lack of automation can make the process all the more complex.

2. Billing

If you run a business that generates revenue from subscription billing, then NetSuite is the best option for you. NetSuite’s billing capabilities far outperform QuickBooks. The entire renewal of the subscription process can be automated. Accounting entries can be created as part of the workflow, without any manual intervention. You can also handle promotional pricing, such as a reduced rate with modified automatic billing after the free trial time, and quickly alter contracts or pause and restart subscriptions.

3. General Ledger

With NetSuite's general ledger, you can:

- modify your GL transactions to match your business needs

- view the accounting data from a consolidated level. And then, drill down to individual transactions,

- add unique GL lines to the transactions

This feature is very helpful in cases where you need to add one or more debit and credit lines to your standard GL lines from any transactions, such as invoices or vendor bills.

That means, reduced time and effort in account reconciliation, period close, and all the related processes.

Multidimensional reporting allows you to add tracking details at the transaction level. Keep your chart of accounts simple! But, good enough to handle complex viewing or reporting requirements.

QuickBooks tries to make its solution work through tags, but there are only so many tags, and they quickly run out as users try to find workarounds.

4. Accounts Payable

QuickBooks lacks automated controls over purchase functions. On the other hand, NetSuite's approval workflow engine provides good control over purchase processes. With NetSuite, all the rules and procedures related to purchasing functions can be set up by way of workflows. The workflows ensure that all purchasing and accounting rules and procedures are adhered to.

For example:

- When vendor bills do not match with the purchase orders, users can automate discount computation and exceptional processing. This reduces manual data input errors and the time it takes to handle vendor bills.

- NetSuite provides role-based restricted access to data and functionalities. This help maintains the segregation of tasks.

In comparison, QuickBooks provides only a restricted approval workflow.

5. Accounts Receiveable

With NetSuite, you can provide your customers with self-service user access. This helps your customers to check inventory status, raise sales orders and view statements of accounts and initiate payment of invoices.

6. Fixed Assets and Lease Management

With the Fixed Assets module in NetSuite, you can manage the complete life cycle of your Assets. For example,

- track depreciating or nondepreciating firm assets from creation to depreciation

- automate depreciation entries, revaluation of assets, disposal of assets

NetSuite also solves the new accounting and reporting requirements for leased assets, including:

- the creation of amortization schedules

- separation of interest expenditure from the rental expense for balance sheet and income statement reporting

- related accounting treatments and the accounting entries

These fixed asset and leasing management functions are not available in QuickBooks.

7. Inventory Management

Inventory Management in NetSuite automates real-time tracking of inventory levels, orders, and sales across the inventory lifecycle. It helps reduce manual processes and provides the insights needed to make data-driven choices.

QuickBooks inventory management isn't built to serve organizations that deal with large amounts of raw materials or products that use granular material. If you intend to use QuickBooks for Inventory management, users will need to depend on spreadsheets or other tools.

8. Reporting

In addition to standard reports which most of the software including QuickBooks provides, NetSuite provides reports on:

- revenue projections

- consolidated parent and subsidiary reports

- reports in local currency of the countries where subsidiaries are located

- consolidated reports in any currencies at the consolidated company level

Further, the consolidations can be at multiple levels each with different currencies depending on the country or currency. Multi-currency is only accessible in QuickBooks Online as an advanced feature.

Which Accounting Software is Better for Business?

The short and simple answer is that it depends.

Both NetSuite ERP and QuickBooks Online are tailored to specific customer groups.

For many small businesses just getting off the ground, QuickBooks is obviously an ideal solution. When bookkeeping is all that is needed and accounting demands are minimal, generating month and year-end reports and helping with annual business taxes is enough. It is not, however, intended to be a long-term accounting software solution.

Many businesses implement NetSuite ERP because it is more than just a better accounting system; it is a complete solution to manage the entire operations of your organization.

NetSuite incorporates Customer Management, e-Commerce, HR, Project Management, Inventory Management, Supply Chain Management, and more — the breadth of functions combined with the integrated system makes NetSuite more appealing to growing businesses.

Why do businesses choose NetSuite ERP over QuickBooks?

- For a greater level of automation

- To increase efficiency in complex business processes

- For upgrading accounting and financial function

- Say goodbye to clusters of disparate applications

- To lower costs and boost productivity in the long run

By now, you may already be thinking of switching from QuickBooks to NetSuite to manage your accounting and finance.

If cost is a deciding factor...

QuickBooks is less expensive than NetSuite. If you own a small business or simply want an inexpensive and effective solution to manage your books remotely, QuickBooks is a good option that will vary depending on your requirements. It depends on the operational automation you need to implement and achieve. It depends on the Modules needed like, CRM, Advanced Inventory, Project Management, Work orders, etc.

The cost of NetSuite will vary depending on your requirements. It depends on the operational automation you need to implement and achieve. It depends on the Modules needed like, CRM, Advanced Inventory, Project Management, Work orders, etc.

The Wrap...

You should thoroughly analyze your business needs before selecting the best accounting software for your firm.

Companies are more likely to seek better solutions as their business grows. Many organizations that have outgrown software like QuickBooks, Sage, Tally, and others utilize NetSuite as their accounting and ERP solution.

No matter how big or quick your company expands, we recommend using a complete solution. One single system for entire operations. A system that takes care of your requirement... No matter how fast you grow. No matter which new vertical or industry segment you start a new business and grow. Your System should be built in such a way that it works for you. Forever.

A system that will be your last system update!

LEAVE A REPLY

Related Topics

2 years ago

02 May 2024

KPI

NetSuite ERP Consultants - Who they are and how to be successful?

Learn more about what a NetSuite consultant does, how to become NetSuite Consultant, and how they can help you with your NetSuite implementation project

2 years ago

03 Oct 2022

KPI

10 Reasons Why SMEs Should Adopt NetSuite Cloud ERP

See why SMEs should get rid of their outdated systems and invest in the highly beneficial NetSuite Cloud ERP software!

2 years ago

03 Mar 2024

KPI

8 Key Differences between On Premise ERP and Cloud ERP

Compare Cloud ERP & On-Premise ERP: Dive into benefits, costs, & scalability to determine which solution best fits your business needs. A brief guide from KPI

2 years ago

03 Jun 2022

KPI

5 Actions to Boost NetSuite ERP Security

Learn how you can adopt best practices to implement NetSuite Security, and enhance data protection.

1 year ago

14 Aug 2024

KPI

Top 5 Oracle NetSuite Partners in UAE

With so many types of partners available, finding the ideal one for your business can feel like navigating a maze. Don't worry; we've got you covered!

2 years ago

21 Jun 2022

KPI

Rise of Last Mile Delivery Companies in the UAE

Get deeper insights into challenges & future of a growing last-mile delivery industry in UAE straight from the horse's mouth.