- Activities under the scope of Economic Substance Regulation

- Important Aspects of the Economic Substance Regulation

- 1. Who is a Relevant Entity?

- 2. What are the reporting requirements of a Relevant Entity?

- 3. What is the content of the annual Economic Substance Regulation Report?

- 4. What if the Relevant Entities are non-compliant with the regulations?

- 5. Who is the Regulatory Authority?

- 6. What are the ESR compliance requirements?

ESR UAE: Your Guide to understanding Economic Substance Regulations

Updated on : 28 May 2024

Published : 10 Jun 2022

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

The Economic Substance or ESR requires UAE onshore and free zone companies and certain other business forms to maintain and demonstrate an adequate “economic presence” in the UAE relative to the activities they undertake (“Economic Substance Test”).

The regulation applies to financial years commencing on or from 1 January 2019. Entities that are within the scope of the Regulations are required to submit an annual Notification form to their Regulatory Authority, and complete and submit to the same Regulatory Authority an Economic Substance Report within 12 months from the end of their financial year.

How did Economic Substance Regulation come into effect in UAE?

Following the introduction of Economic Substance Regulations in the UAE and the Specific Guidance on those regulations (Ministerial Decision 215 of 2019) issued by the UAE Ministry of Finance, the EU is set to remove the UAE from a list of non-cooperative tax jurisdictions.

In 2019, the European Union (EU) Code of Conduct Group, responsible for business taxation and assessing the tax measures for all its member states, investigated the tax policies of jurisdictions with no tax or nominal tax. As a result, the EU published a list of non-cooperative tax jurisdictions, which includes the UAE.

The UAE joined Organization for Economic Co-operation and Development (OECD), Base Erosion and Profit Shifting (BEPS) Inclusive Framework in May 2018, through which the UAE was committed to implementing the minimum standards of BEPS Inclusive Framework. In response to this, the UAE published its Economic Substance (ES) Regulations through Cabinet Decision No. 31/2019 on 30 April 2019.

Activities under the scope of Economic Substance Regulation

The Economic Substance Regulations primarily apply to any entity (Mainland or Free Zones) within the UAE that undertakes “Relevant Activities”. These Relevant Activities are as follows:

- banking,

- insurance,

- investment fund management,

- lease-finance,

- headquarters,

- shipping,

- holding companies,

- intellectual property,

- distribution and service centers

An entity carrying out Relevant Activities must comply with the Economic Substance or ES requirements. However, entities that are directly or indirectly owned by the UAE government (federal and local) are outside the scope of ES.

Of these nine relevant activities listed under the Economic Substance Regulations. Learn more about four key business activities in particular

Important Aspects of the Economic Substance Regulation

1. Who is a Relevant Entity?

In order to meet the ES requirements in relation to Relevant Activities, the entity must satisfy the following:

- conduct Core Income-Generating Activities (CIGA) in UAE;

- be directed and managed in the UAE with respect to its CIGA;

- have an adequate number of qualified full-time resources in UAE;

- incur sufficient amount of operating expenses in UAE;

- have adequate physical assets in the UAE

An entity may outsource its CIGA within the UAE, provided the entity retains full control and demonstrates adequate supervision over those activities and outsourced activities are carried out inside the UAE.

2. What are the reporting requirements of a Relevant Entity?

Entities that fall within the ambit of the new Regulations will be required to prepare and submit a report to the Regulatory Authority (License issuing Authority) not later than 12 months after the end of the entity’s financial year. The Regulatory Authority will then submit the report to the competent authority, the UAE Ministry of Finance.

UPDATE: Have you filed your ESR Notification this year?

3. What is the content of the annual Economic Substance Regulation Report?

The report shall include the following information in respect of Relevant Activity:

- the type of activity conducted;

- the amount and the type of income;

- amount and type of operating expenses and assets;

- place of business;

- number of full-time employees with qualifications;

- information on CIGA;

- declaration as to whether the licensee satisfies the ES test;

- gross income from a Relevant Activity is subject to tax outside the UAE;

- entity's financial year-end

4. What if the Relevant Entities are non-compliant with the regulations?

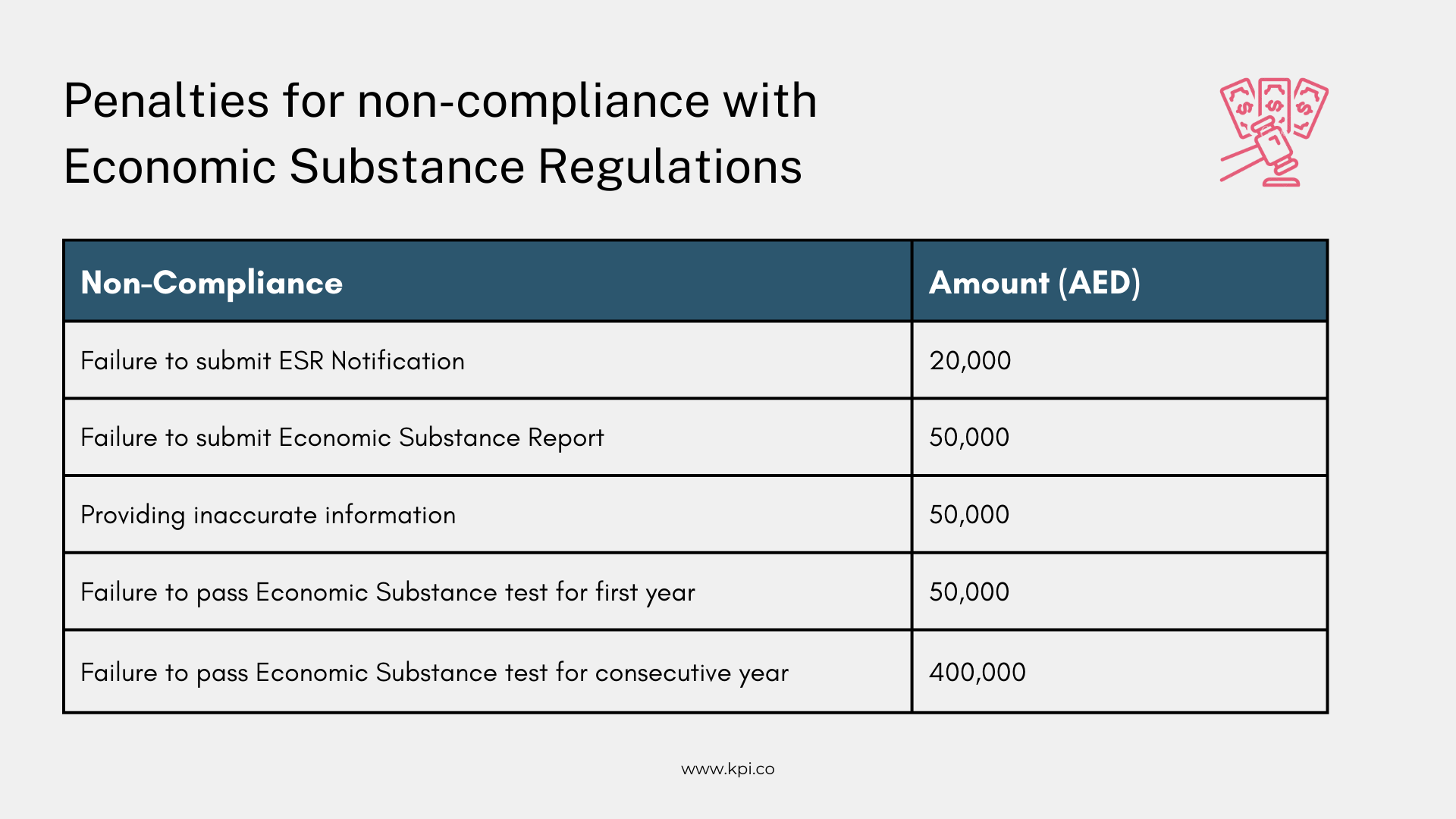

Non-compliance can result in administrative penalties for failure to meet the economic substance test. The penalty is up to AED 50,000 in the first financial period and up to AED 400,000 in subsequent financial periods. The administrative penalties for failure to provide information is up to AED 50,000.

5. Who is the Regulatory Authority?

The regulatory authorities are responsible for monitoring compliance with the Notification and reporting obligations under the Regulations, identifying possible Licensees, validating information submitted, determining whether a relevant entity meets the requirements to be treated as exempt, and sharing information with the UAE Federal Tax Authority and the UAE Ministry of Finance.

6. What are the ESR compliance requirements?

A licensee is required to submit a notification, in the form and manner specified by the Regulatory Authority, before the deadline, which is 6 months from the end of the respective financial year. The Regulatory Authorities have specified the deadline for their respective jurisdiction. A licensee is also required to submit an Annual Report within 12 months from the end of the respective financial year.

All entities operating in the UAE should assess their activities in the light of new ES Regulations and ensure compliance with the Regulations and the reporting requirements on a timely basis.

A milestone in UAE's Tax Policy - ESR UAE

The introduction of the new Economic Substance Regulations is a milestone for the UAE’s tax policy towards its alignment with the global Organization for Economic Cooperation and Development’s (OECD) Base Erosion and Profit Shifting (BEPS) directives. It demonstrates UAE’s commitment to curtailing international tax avoidance strategies that exploit the gaps and mismatches in the tax laws globally.

Download the full document of the ES Regulation issued by the UAE Ministry of Finance: Download PDF

For more information on Economic Substance Regulation in UAE: Go to the Ministry of Finance's official ESR Page

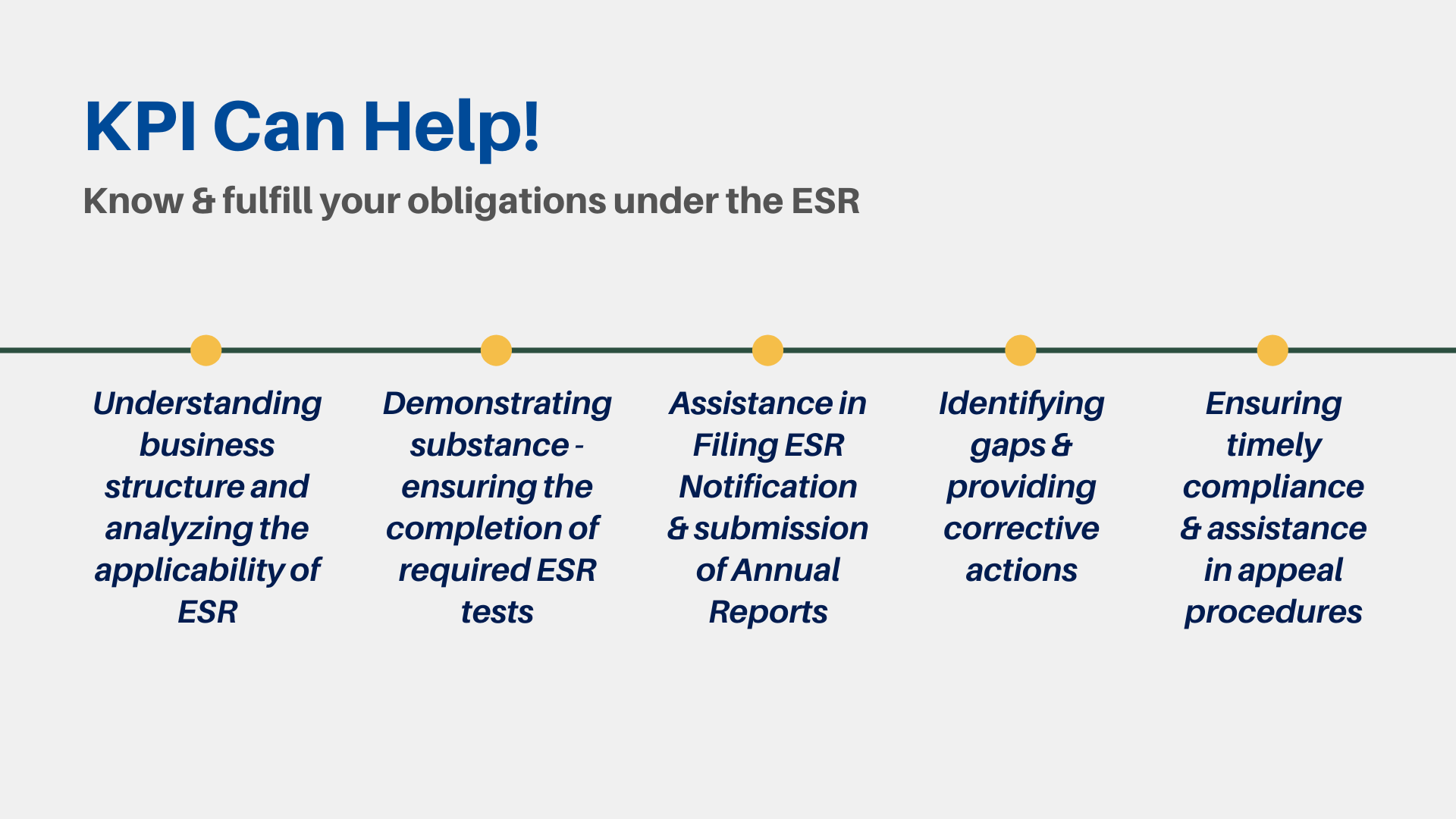

Connect with our ESR advisory team

KPI's rich experience and the committed advisory team can help your business to take the required measures and assist in compliance of the Economic Substance Regulations framework.

If there is anything you would like us to help you with, leave your queries below.

LEAVE A REPLY

Related Topics

2 years ago

13 Jun 2022

KPI

ESR UAE: Demonstrating Substance Under Economic Substance Regulation

Find out the key requirements for a Licensee to submit Economic Substance Regulation in UAE

2 years ago

13 Jun 2022

KPI

Economic Substance Regulations - Impact of ESR on Key Relevant Activities

Assessing the impact of Economic Substance Regulations on key business activities. Learn more.