Economic Substance Regulations - Impact of ESR on Key Relevant Activities

Updated on : 28 May 2024

Published : 13 Jun 2022

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

In 2019, the UAE Government issued a series of Directives and Resolutions, collectively referred to as the “Economic Substance Regulations” or the ESR. The purpose of the ESR is to curb harmful tax practices in UAE, in compliance with OECD international standards, and with the guidelines issued by the European Union Code of Conduct Group on Business Taxation.

The scope of the ESR provisions includes all companies completing relevant activities apart from any commercial company owned directly or indirectly by the UAE Government or any subordinate government authority.

Understanding the impact of ESR on key business activities

Of the nine relevant activities listed under the Economic Substance Regulations (Blog article), entities should consider the following four activities in particular:

- holding companies

- headquarter business

- service center business

- lease finance business (includes provision for loans to related and third parties for consideration)

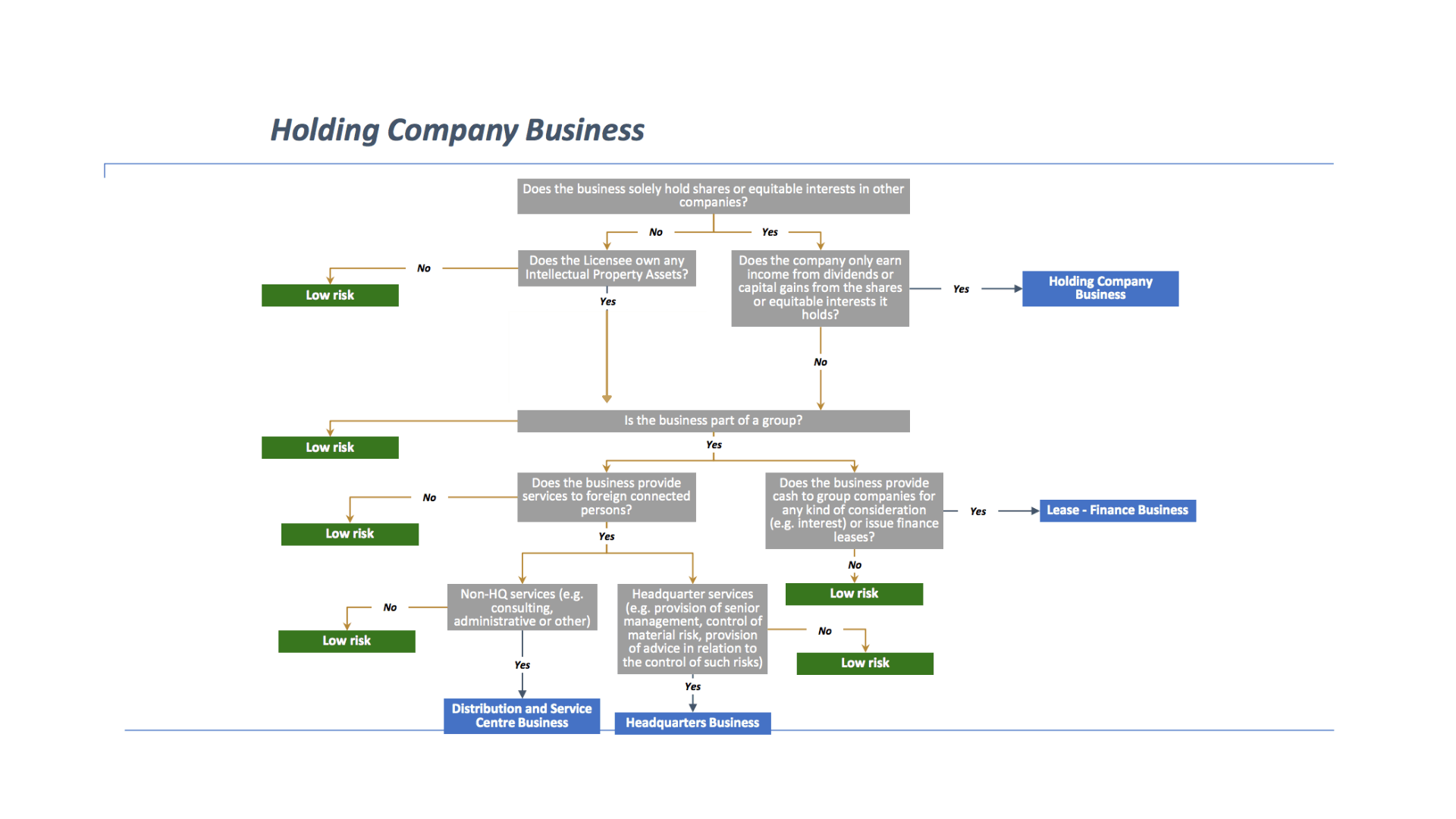

1. Holding Companies

What are holding companies?

An entity in the UAE is considered a holding company (as per ESR) when it meets the criteria below:

- The company holds inquiry interests in juridical persons

- It only earns dividends and capital gains from its equity investments

Hence a company in the UAE that holds assets and has other income streams apart from dividends and equity is not considered a holding company

Core Income Generating Activities for Holding Companies (CIGA)

The CIGAs of a holding company business are all activities related to acquiring and holding shares or equitable interests in other companies, provided that such activities do not constitute another Relevant Activity, in which case, the CIGAs shall be those related to that other Relevant Activity

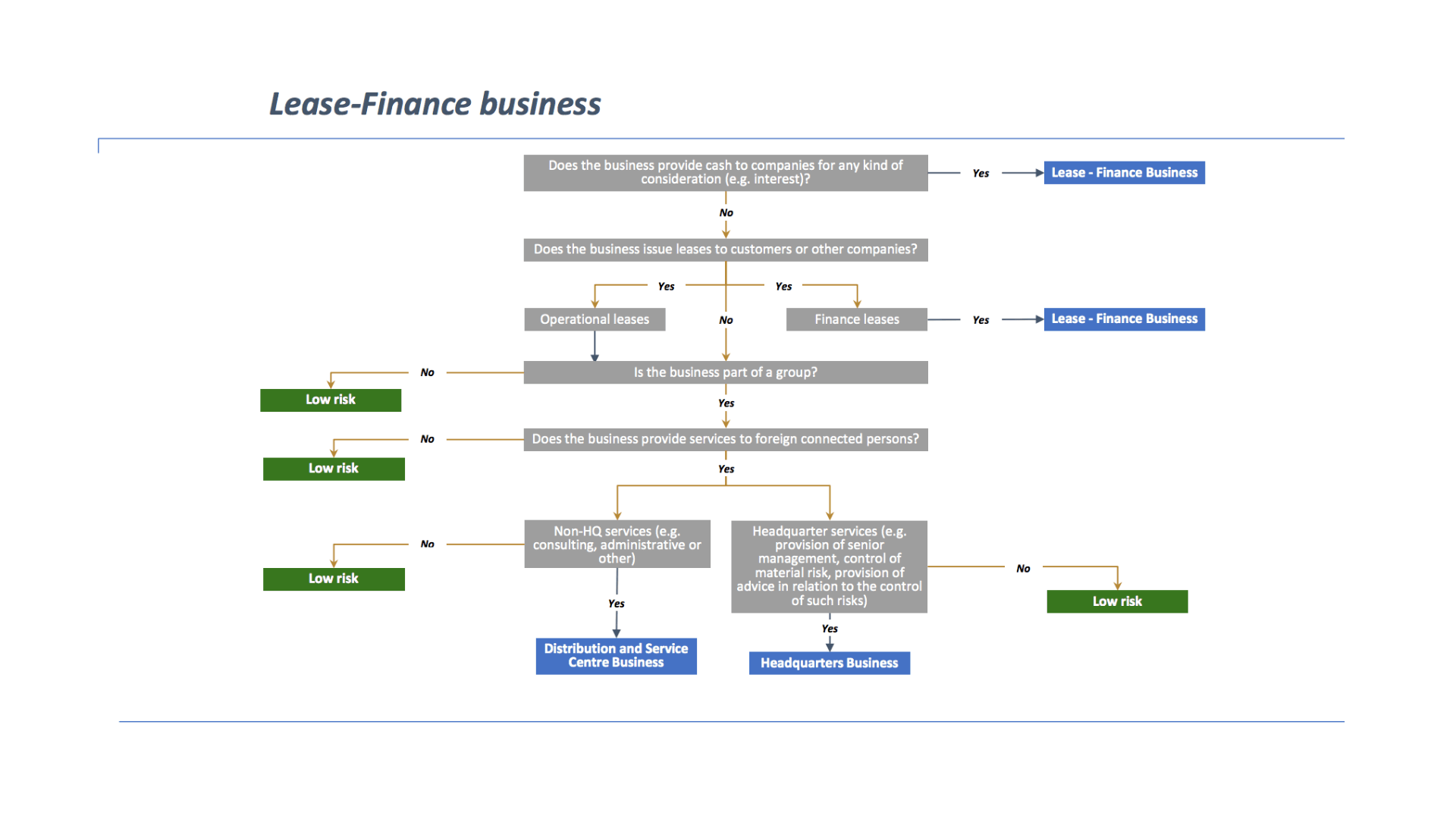

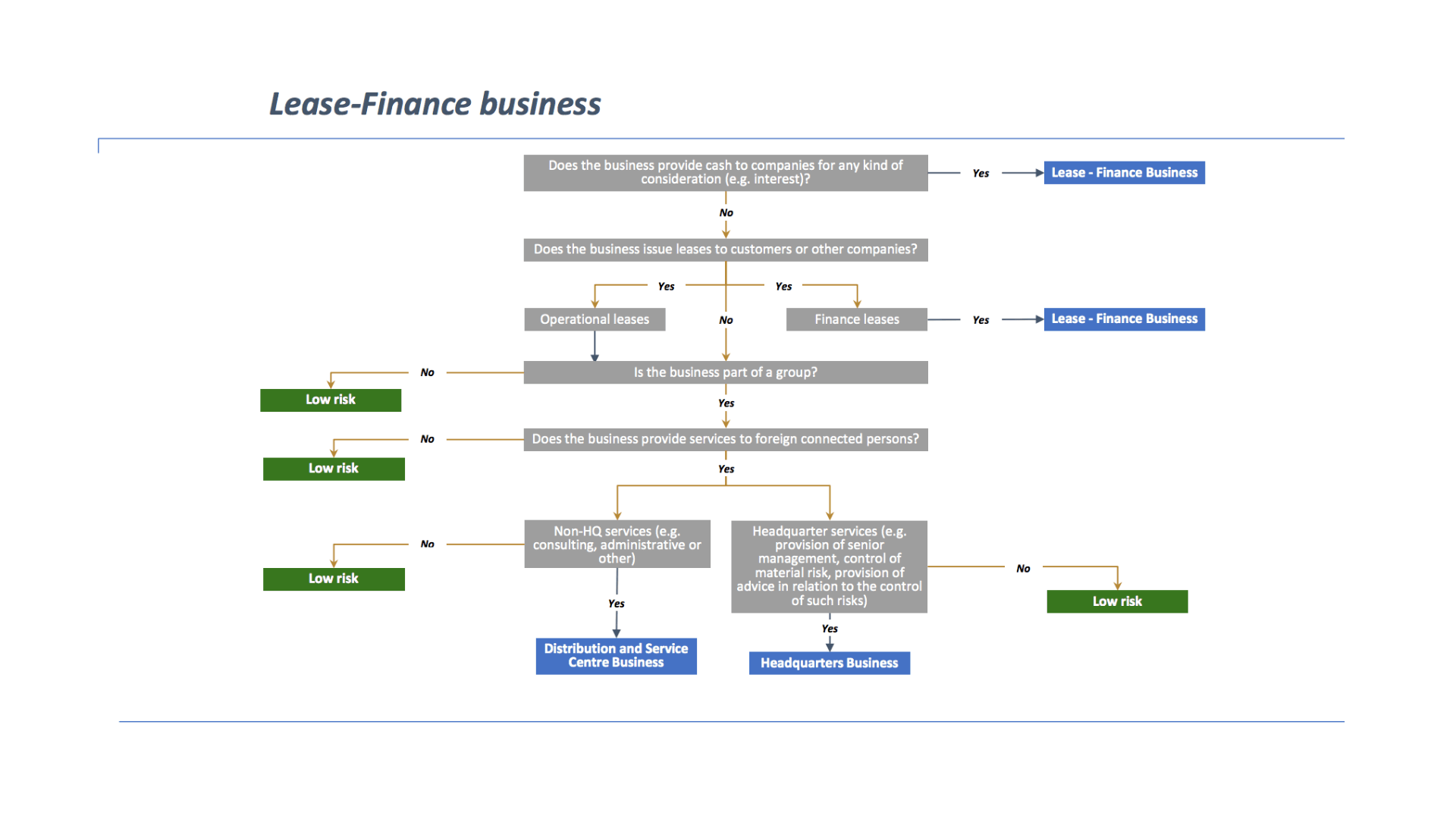

2. Lease Finance Arrangements

What are the activities treated as lease finance arrangements?

From the ESR perspective, lease finance activities include offering credit or financing for any kind of consideration, intra-group financing (including making loans to related or unrelated parties, financing leases for assets except land, hire purchase agreements, long-term credit plans, any other form of financing arrangements). Such activities should expect a generation of consideration from the licensee.

Core Income Generating Activities for lease finance arrangements

- Agreeing on funding terms

- Identifying & amp; acquiring assets to be leased

- Setting the terms& duration of any financing or leasing nbsp;

- Monitoring and revising any agreements

- Managing any risks

Regulatory Authority

- UAE Central Bank

- Competent Authority in Financial Free Zones

Exception from Duplicate ESR Reporting: A licensee engaged in Banking, Insurance, and Investment Fund Management business may also perform lease or financing activities as a normal part of their business and such licensee are not to be required to demonstrate substance under Lease Finance business to avoid duplicate reporting for the UAE ESR.

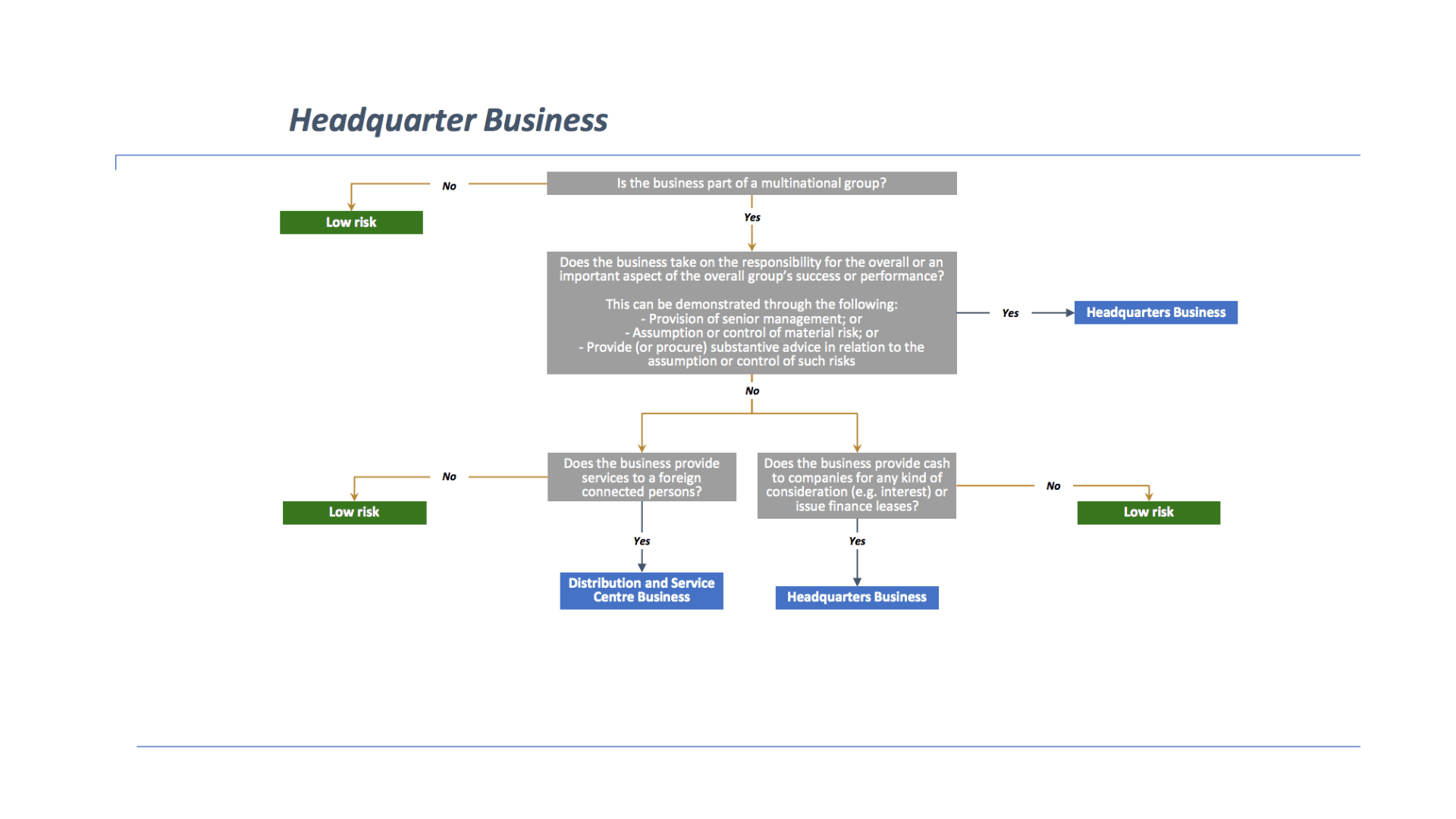

3. Headquarters Business Activities

What are Headquarter Business Activities?

If you have a license from a UAE authority, and you are providing certain services to your foreign group companies, and such services are essential in achieving the overall objectives/success of the group, or the licensee is responsible for the group’s performance, then the licensee is considered to be conducting headquarters business activities, and accordingly, the licensee is required to comply with the UAE Economic Substance Regulations (ESR).

What are the services that are considered as a Headquartered Business?

Services include the provision of senior management, assumption or control of material risk for activities carried out by foreign group companies or substantive advice in relation to assumption or control of such risks. The position of the licensee in the group organization structure is not relevant for determining whether it is engaged in providing headquarters services.

Exception from duplicate ESR reporting: A licensee engaged in Banking, Insurance, Investment Fund Management, Lease-Finance, Shipping or Distribution, and Service Centre businesses may also provide headquarter services to their foreign group companies as a normal part of their business and such licensee is not be required to demonstrate substance under headquarter business to avoid duplicate reporting for the UAE ESR.

Core Income Generating Activities for Headquartered Business

- Taking relevant management decisions

- Incurring operating expenditures on behalf of group entities

- Coordinating group activities

Regulatory Authority

- UAE Central Bank

- Competent Authority in Financial Free Zones

4. Distribution or Service Center Business

What is a distribution business?

Activity in relation to the import of raw material, components, or finished products from a foreign connected person and storing in the UAE, for reselling the same outside of the UAE is considered as a distribution business for the purpose of UAE ESR. A licensee that only purchases and distributes/resells to third parties is not considered to be engaged in a distribution business.

What is a service center business?

Activity in relation to providing consulting, administrative or other services to a foreign connected person outside the UAE is considered as a service center business for the purpose of UAE ESR. A licensee that only provides services to third parties is not considered to be engaged in a service center business.

Core Income Generating Activities for Distribution or Service Center Business

- Transporting and storing goods, components, and materials or goods ready for sale

- Managing inventories

- Taking orders

- Providing consulting or other administrative services

Regulatory Authority

- Ministry of Economy

- Competent Authority in Financial Free Zones

Have questions on complying with ESR?

KPI's rich experience and the committed advisory team can help your business to take the required measures and assist in compliance with the Economic Substance regulatory framework.

LEAVE A REPLY

Related Topics

2 years ago

13 Jun 2022

KPI

ESR UAE: Demonstrating Substance Under Economic Substance Regulation

Find out the key requirements for a Licensee to submit Economic Substance Regulation in UAE

2 years ago

10 Jun 2022

KPI

ESR UAE: Your Guide to understanding Economic Substance Regulations

Learn how the Economic Substance Regulations in UAE came into effect, the purpose, applicability & impact on your business.