- First, what is the TRC?

- Why do you need a Tax Residency Certificate?

- How an entity or a company can get tax residency certificate?

- How an individual can get tax residency certificate?

- How to get the Tax Residency Certificate or Tax Citizen’s Certificate?

- What are the impacts of International Agreements?

- In what form the TRCs will be issued in UAE

- What is the Authority’s Power under this decision?

- What documents are required to determine tax residency?

UAE Tax Residency Certificate (TRC): What? Why? And how?

Updated on : 28 May 2024

Published : 04 Nov 2022

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

The UAE has issued a Cabinet Decision on the tax residency of Companies and individuals in the UAE. This legislation will take effect from March 1, 2023.

UAE is set to introduce Corporate Tax soon. The cabinet decision provides clarity on the residential / domicile status of Corporates and Individuals in the country.

In this article, I would like to cover:

- what you need to know about the tax residency certificate

- who need to have it and for what purpose

- how to apply and obtain the tax domicile certificate

First, what is the TRC?

The Tax Residency Certificate is an official document. The document is issued for companies or individuals who are eligible. Government entities are also eligible to get the Certificate.

Why do you need a Tax Residency Certificate?

Following are some of the reasons why you as an entity or individual need a TRC.

- To prove that the applicant is a resident of UAE

- To take advantage of Double taxation agreements or treaties between two countries

- To ease the process of cross-border trade and investment flows

- To encourage the development goals of UAE

- For economic diversification

- To avoid paying taxes in the two countries for the same income

How an entity or a company can get tax residency certificate?

A Company will be considered tax resident in the UAE under the following conditions:

- The Company was established, formed, and recognized as per the UAE legislations. This includes companies formed in the free zones and financial free zones.

- Offshore companies are not eligible to obtain TRC.

- A Branch of a foreign company is not considered as a Legal person/Company in the UAE for tax residency purposes. So, branch of a foreign company is not eligible to get the TRC.

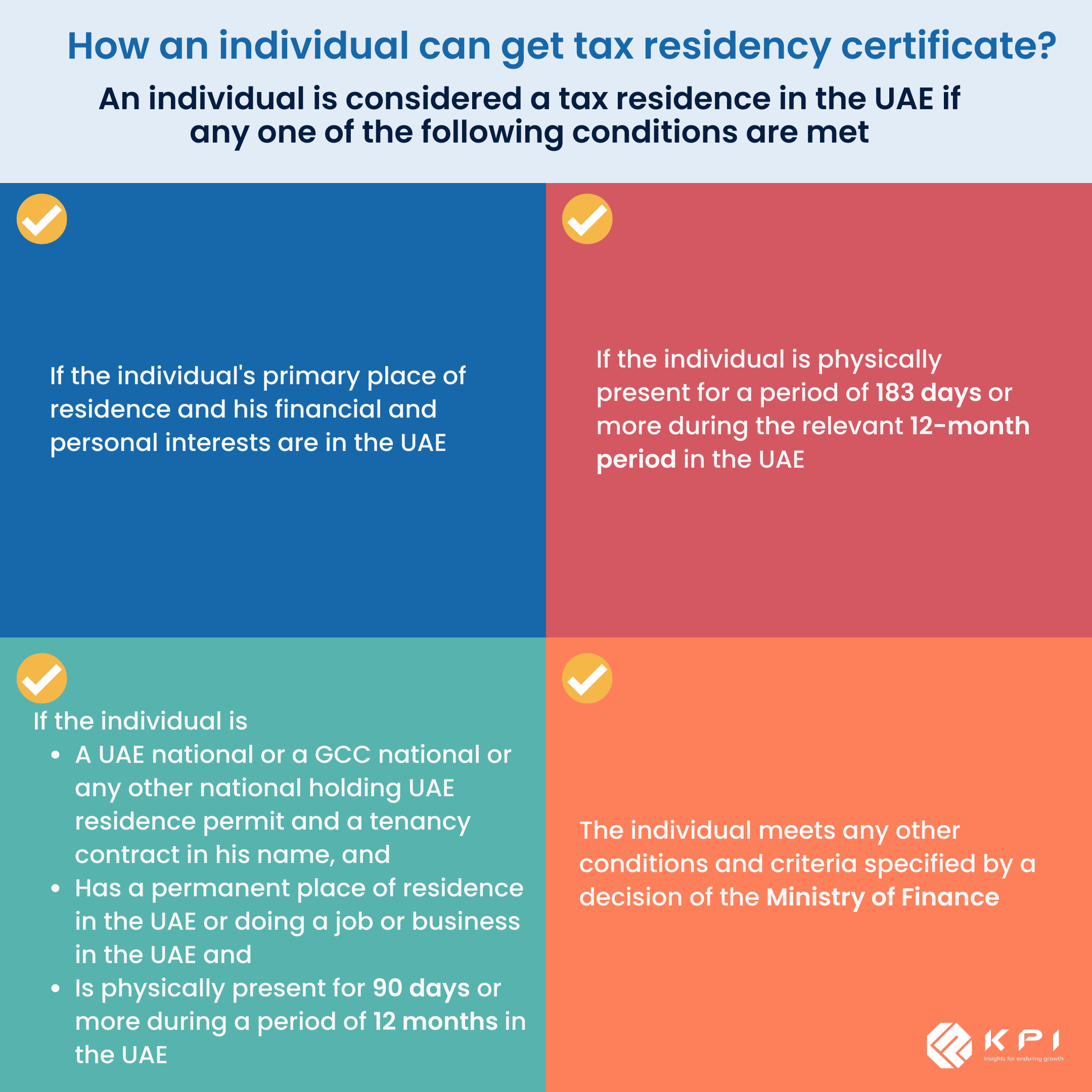

How an individual can get tax residency certificate?

An individual is considered a tax residence in the UAE if any one of the following conditions are met:

- If the individual's primary place of residence and his financial and personal interests are in the UAE; or

- If the individual is physically present for a period of 183 days or more during the relevant 12-month period in the UAE

- If the individual is

- A UAE national or a GCC national or any other national holding UAE residence permit and a tanancy contract in his name, and

- Has a permanent place of residence in the UAE or doing a job or business in the UAE and

- Is physically present for 90 days or more during a period of 12 months in the UAE.

- The individual meets any other conditions and criteria specified by a decision of the Ministry of Finance

How to get the Tax Residency Certificate or Tax Citizen’s Certificate?

- Submit an application to the Certificate issuing Authority

- Such application should be submitted in accordance with the form and method prescribed by the Authority

- If satisfied with the application and the documentation, the Authority may approve the application and issue a Tax Residency Certificate in UAE

What are the impacts of International Agreements?

In cases where UAE has signed an international agreement with any other country or Agencies

- Any special provisions or conditions specified in such agreement will be considered by the Certificate issuing agency in UAE. And provisions of such agreement will be applied.

In what form the TRCs will be issued in UAE

- The form of issuing tax domicile certificates (whether printed or in digital form) will be prescribed by the Authority

What is the Authority’s Power under this decision?

The certificate issuing Authority has the power to request the applicant or any other government agencies in UAE

- Any information,

- Data or documents

- or any other details

What documents are required to determine tax residency?

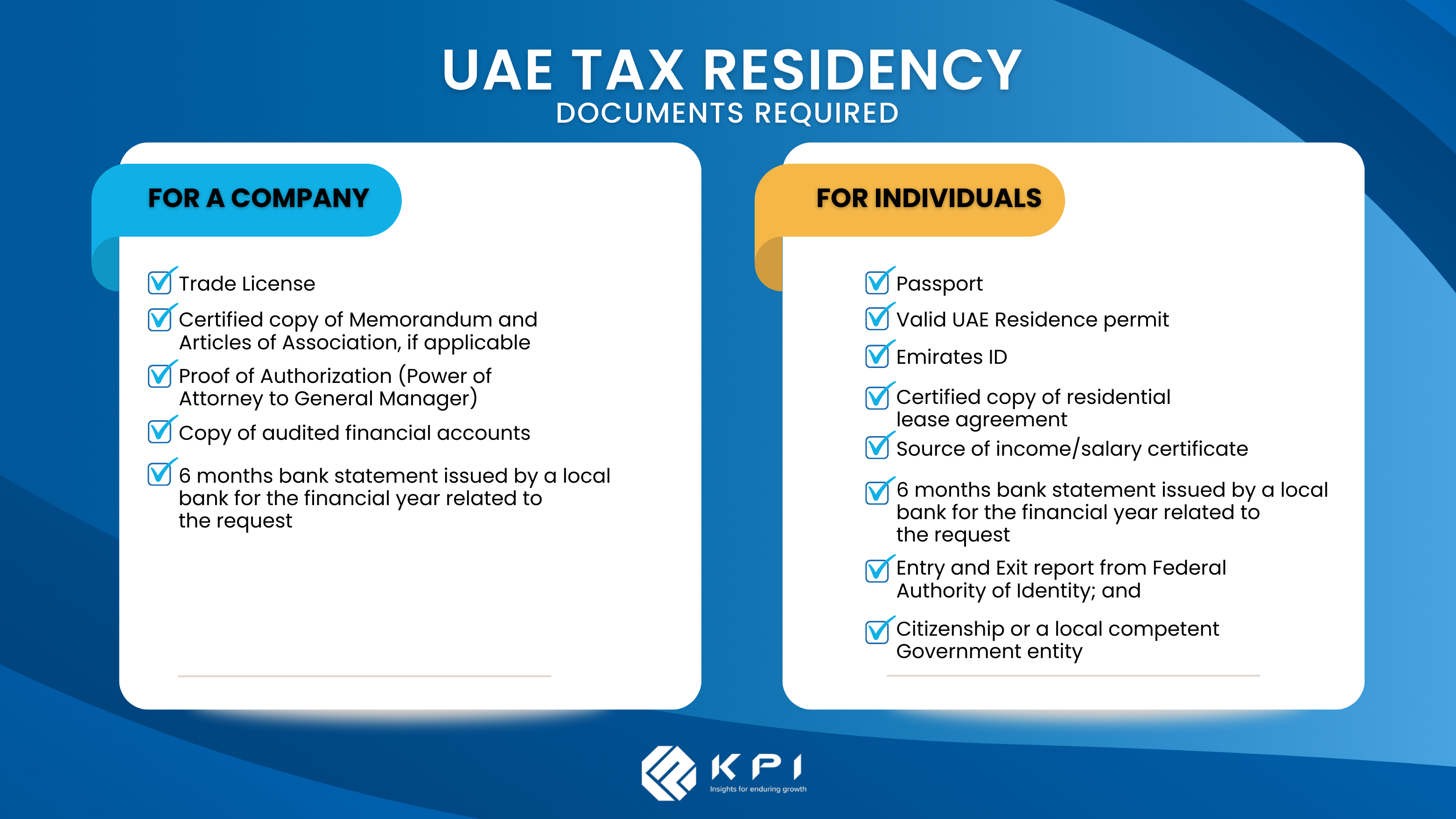

Copies of the following documents are required for tax residency certificate application:

For a Company

- Trade License

- Certified copy of Memorandum and Articles of Association, if applicable

- Proof of Authorization (Power of Attorney to General Manager)

- Copy of audited financial accounts

- 6 months bank statement issued by a local bank for the financial year related to the request

For an Individual

- Passport

- Valid UAE Residence permit

- Emirates ID

- Certified copy of residential lease agreement

- Source of income/salary certificate

- 6 months bank statement issued by a local bank for the financial year related to the request

- Entry and Exit report from Federal Authority of Identity; and

- Citizenship or local competent Government entity

Contact us to check our corporate tax services.

LEAVE A REPLY

Related Topics

2 years ago

21 Jun 2022

KPI

Corporate Tax in UAE: Consultation document UAE Ministry of Finance

Have a say in how the UAE Corporate Tax laws should be - submit your comments and learn more about the new CT Law.

2 years ago

22 Mar 2023

KPI

UAE Tax Residency Certificate: Cost and Simplified Guide

Secure your UAE tax residency certificate with our simple step-by-step guide. Get started today and stay compliant!

2 years ago

21 Jun 2022

KPI

Corporate Tax: Loss carry forward - What, When and How much?

All the answers on Tax loss carry forward under the new Corporate Tax Law.

2 years ago

20 Jun 2022

KPI

UAE Corporate Tax Rates: How to Calculate your tax liability

Calculating your tax liability under the Corporate Tax Law.

2 years ago

06 Feb 2022

KPI

New Corporate Tax in UAE: All You Need to Know

The Corporate Tax Law is a Federal Law that will apply to all businesses and commercial activities(legal entities)in the UAE. Find out more.

2 years ago

20 Jun 2022

KPI

Are companies in UAE Free Zones subject to Corporate taxes?

Find out how the UAE CT regime would honour tax incentives for Free Zone Persons.