UAE Tax Residency Certificate: Cost and Simplified Guide

Updated on : 22 Jul 2024

Published : 22 Mar 2023

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

Are you a tax resident in the United Arab Emirates (UAE) and want to benefit from Double Tax Avoidance Agreements (DTAA)? Well, you need a Tax Residency Certificate (TRC) to do so.

In this blog post, we’ll guide you through the process of obtaining a TRC, highlight some rules for determining tax residency, and provide insight into the cost of getting one.

Determining Tax Residency: What You Need to Know

Before diving into the process of obtaining a Tax Residency Certificate, let's clarify some rules on determining tax residency. The Ministry of Finance in the UAE recently issued a decision that clarifies the rules for determining tax residency. You are considered a tax resident of the UAE if you spend 183 or more days in the country in a continuous period of 12 months.

But did you know that having a permanent address is not a prerequisite to qualify for a TRC? The only requirement is that “such place must be continuously available to them.” Additionally, all days or parts of a day that you spend in the UAE will be counted in determining the 183-day threshold.

Eligibility Criteria for TRC in UAE

Natural Persons: A natural person's tax residency is determined by elements like their usual primary place of residence and the center of their financial and personal interests in a specific state. Meeting specific requirements outlined in a decision from the Minister may be necessary for this conclusion.

Legal Persons: For legal persons, you must have been established for at least one year. Juridical persons are regarded as tax residents of the State if either of the following situations applies:

- It was established, organized, or acknowledged by state law.

- A juridical person's tax residency is established by the applicable state tax law. The tax treaty's terms will take precedence in determining the juridical person's tax residency status.

With these rules in mind, let's move on to the steps to obtain a TRC.

Step-by-Step Guide to Obtaining a Tax Residency Certificate

So, how can you apply for a TRC in the UAE through the FTA portal? Here’s how:

- Start by setting up an account on the Federal Tax Authority (FTA) website

- Once logged in, go to the 'Services' tab,

- Select 'Certificates' from the drop-down menu

- Choose 'Request for Tax Residency Certificate'

- Fill in the necessary fields. This includes your name, Emirates ID number, tax registration number (if available), and contact details

- Upload all the required documents (depending on you status: individual or legal entity) E.g. copy of your passport, Emirates ID, utility bill, tenancy contract, entry/exit certificate, trade license, bank statements, certificate of incorporation, memorandum of association, audited accounts, etc

- Double-check all the details in the application for accuracy before submitting

- Submit the application and pay the processing fee on the payment gateway

- Upon receiving your application, the FTA will review it. If your application is approved, the FTA will issue your TRC within a few days

- You will receive the TRC via email and you can also download it from your FTA account

It’s important to keep in mind that the process may vary depending on the type of applicant applying for the TRC (Individual or legal entity).

According to the FTA website, the application process takes on average 45 minutes to complete! Pre-approval for TRC normally takes 4-5 days to complete. The UAE Tax Residency Certificate will be issued within 5-7 working days of the application being approved

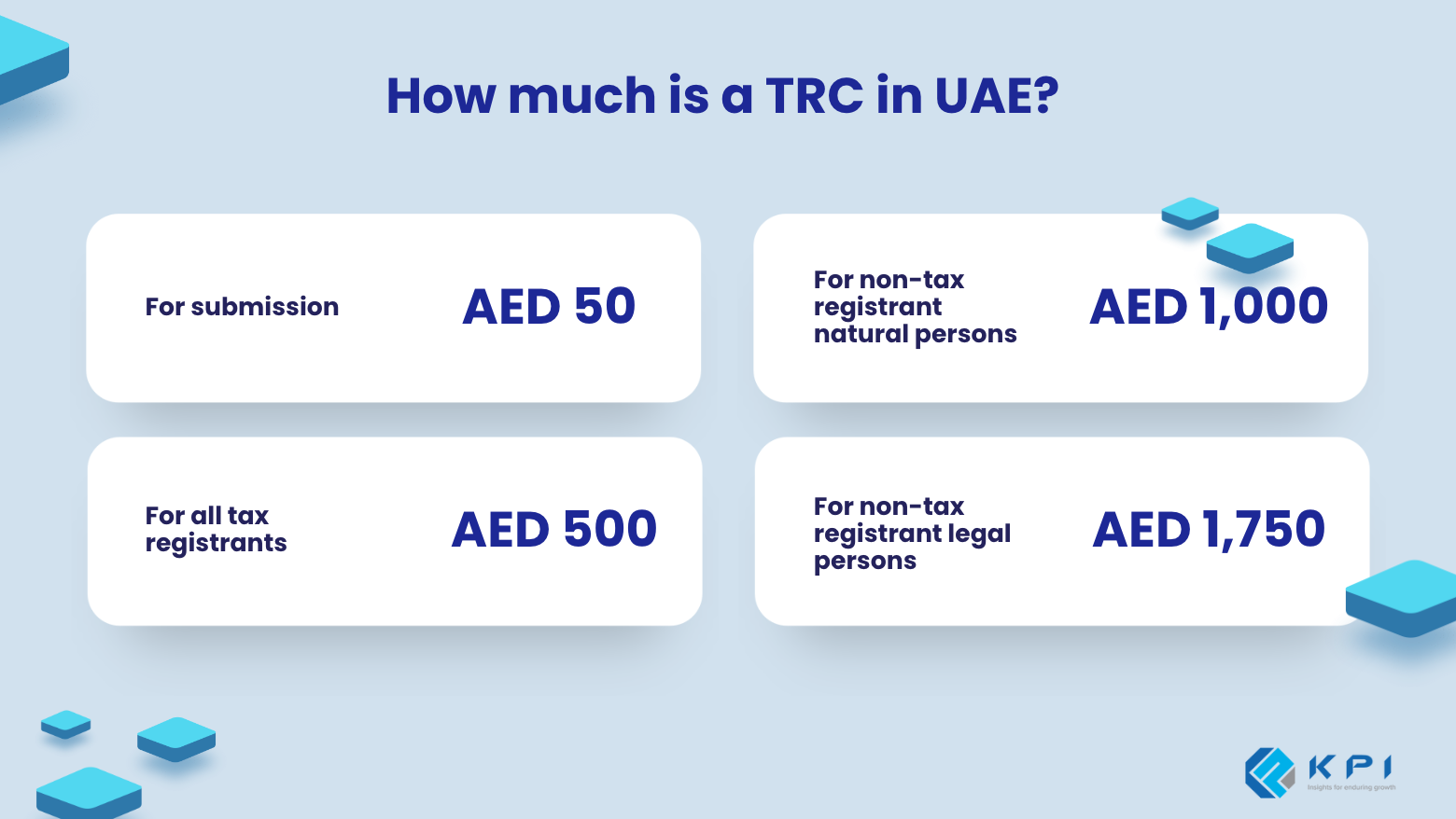

How much is a TRC in UAE?

The cost of obtaining a TRC in the UAE varies depending on whether you are a tax registrant or a non-tax registrant, and whether you are an individual or a legal entity. The fees are as follows:

- AED 50 AED for submission

- AED 500 for all tax registrants

- AED 1,000 for non-tax registrant natural persons

- AED 1,750 for non-tax registrant legal persons

- AED 250 per printed hard copy certificate (optional)

Documents Required to Obtain Tax Residency Certificate

A few important documents have to be submitted to obtain a Tax Residency Certificate, and the specific requirements may vary based on the parties involved.

TRC Requirements For Company:

- A copy of the Certificate of Incorporation.

- Corporate organizational structure.

- Copies of the directors, shareholders, or managers' Passports, along with valid UAE residency visas.

- In addition to having a current UAE trade license (Mainland DED or Free Zone), the business must have been in operation for at least a year.

- A copy of the company's Memorandum of Agreement (Memorandum of Association).

- The UAE company's most recent certified audited financial statements or bank statements for the previous six months, duly stamped by the bank.

- Tax forms (if any) from the country in which the certificate is to be submitted.

TRC Requirements For Individuals:

- Copy of your Passport, your UAE Residence Visa, and Emirates ID.

- A copy of the (residential) lease agreement or Tenancy Contract Copy.

- Proof of permanent place of residence:

Certified lease agreement or electricity bill under the name of the applicant.

Title deed in case of private property.

- Latest Salary Certificate/ Proof of Source of wealth

- The recent and verified Bank statement from the previous six months.

- A report from the General Directorate of Residency and Foreigners Affairs tracking all the entries and exits and the number of days the resident has stayed in the UAE.

TRC Requirements for Investors:

- Company License.

- Name of the Partner.

- Any other documents mentioned earlier.

TRC Requirements For Housewives:

- Marriage Certificate.

- Copy of Passport and Residency Permits of both Husband and Wife.

- Partner's Salary certificate and work contract.

Validity of Tax Residency Certificate

The Tax Residency Certificate in Dubai is valid for one year beginning on the day it is issued. This certificate, often known as TRC Dubai, is accepted by both businesses and individuals. Additional certificate applications may be submitted, depending on certain conditions.

It's important to remember that offshore companies cannot get Tax Residency Certificates. These organizations instead qualify for a tax exemption certificate.

Benefits of Acquiring the Tax Residency Certificate

The UAE's attractive tax environment is only one of the many factors that attract business there. Now that we know why the UAE requires a Tax Residence Certificate, let's look at why acquiring one is so important:

- Income taxes for individuals and businesses are excluded.

- It greatly encourages trade between countries.

- It confirms an individual's or organization's standing in the UAE legal system.

- As you go through the import-export process, having the certificate helps you avoid paying additional taxes

The Wrap

Obtaining a Tax Residency Certificate in the UAE is a simple and straightforward process. By following the step-by-step guide above, you can easily apply for a TRC and benefit from Double Tax Avoidance Agreements.

Nonetheless, with the low cost and clear benefits, it's worth looking into if you're a tax resident in the UAE.

Our team of experts at KPI are ready to help you navigate the UAE tax landscape and ensure compliance with local laws and regulations. Contact us today to learn more.

LEAVE A REPLY

Related Topics

2 years ago

21 Jun 2022

KPI

Corporate Tax: Loss carry forward - What, When and How much?

All the answers on Tax loss carry forward under the new Corporate Tax Law.

2 years ago

17 May 2023

KPI

Corporate Tax in the UAE: Can You Change Your Tax Period?

Can you change your tax period for the UAE Corporate Tax? What are the possible reasons for the change? How to align your financial year? Get the answers here!

2 years ago

20 Jun 2022

KPI

UAE Corporate Tax Rates: How to Calculate your tax liability

Calculating your tax liability under the Corporate Tax Law.

2 years ago

06 Feb 2022

KPI

New Corporate Tax in UAE: All You Need to Know

The Corporate Tax Law is a Federal Law that will apply to all businesses and commercial activities(legal entities)in the UAE. Find out more.

2 years ago

04 Nov 2022

KPI

UAE Tax Residency Certificate (TRC): What? Why? And how?

UAE Tax Residency Certificate (TRC): What? Why? And how?

2 years ago

21 Jun 2022

KPI

Corporate Tax in UAE: Consultation document UAE Ministry of Finance

Have a say in how the UAE Corporate Tax laws should be - submit your comments and learn more about the new CT Law.