- Introduction to UAE Corporate Tax

- Why is the UAE introducing Corporate Tax?

- What principles will be adopted in drafting the Corporate Tax legislation?

- Who will be liable to pay UAE CT?

- Are natural persons (individuals) taxed under the UAE CT?

- What is a UAE-sourced income?

- Who is exempt from paying UAE CT?

- The Wrap...

Corporate Tax in UAE: Consultation document UAE Ministry of Finance

Updated on : 28 May 2024

Published : 21 Jun 2022

KPI

TABLE OF CONTENTS

TABLE OF CONTENTS

Introduction to UAE Corporate Tax

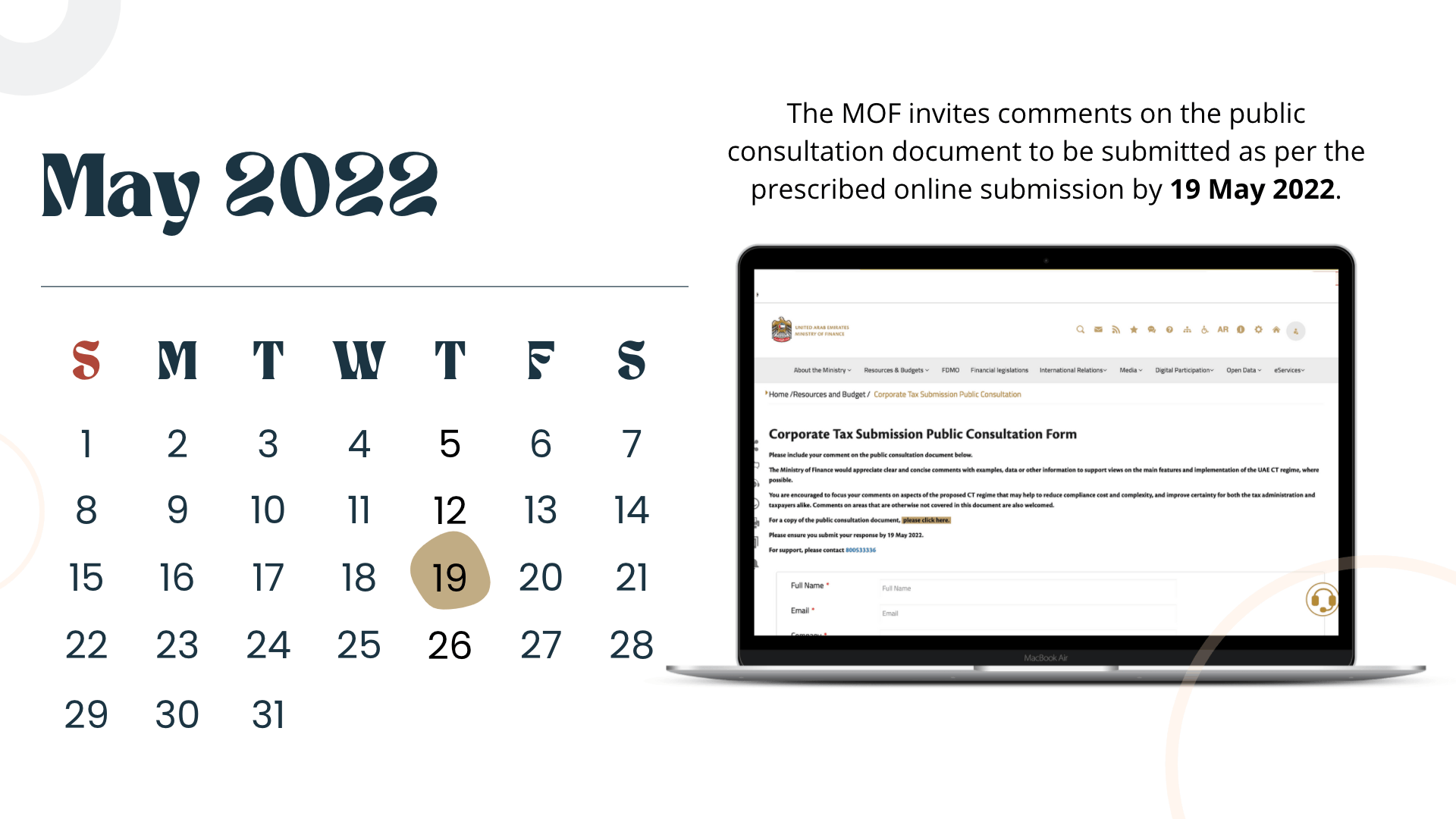

The UAE's Ministry of Finance has released a public consultation document. The document contains information and primary aspects of the proposed UAE CT regime. The purpose of the document is to seek the views and comments of business communities and other interested parties. Interested people may provide their comments on or before 19 May 2022.

The blog series is an attempt to make the consultation paper more understandable so that you may provide feedback. In this blog, we will explore the objective of UAE CT and who are the taxable persons.

Other aspects covered in the blog series include:

- Taxability of Free Zone Companies

- Calculation of Taxable Income

- Treatment of Business Losses

- Tax Groups

- Transfer Pricing

- Disallowed Expenses

Why is the UAE introducing Corporate Tax?

The United Arab Emirates is a global corporate hub and financial center. It is also a signatory to the OECD's Inclusive Framework on Base Erosion and Profit Shifting (BEPS). The UAE supports the worldwide minimum effective tax rate suggested by the OECD.

UAE's proposed tax rate will be one of the lowest in the world. To stay competitive and maintain investor trust.

What principles will be adopted in drafting the Corporate Tax legislation?

The Ministry of Finance is committed to adopting international best practices. The key principles of the Tax regime are:

- Flexibility and alignment with modern business practices.

- Clear and simple. Compliance costs should be minimum.

- Neutrality and equity. The regime should apply to all commercial activities alike with no sector-specific incentives.

- Transparency. Business should understand their obligations for fair and effective enforcement.

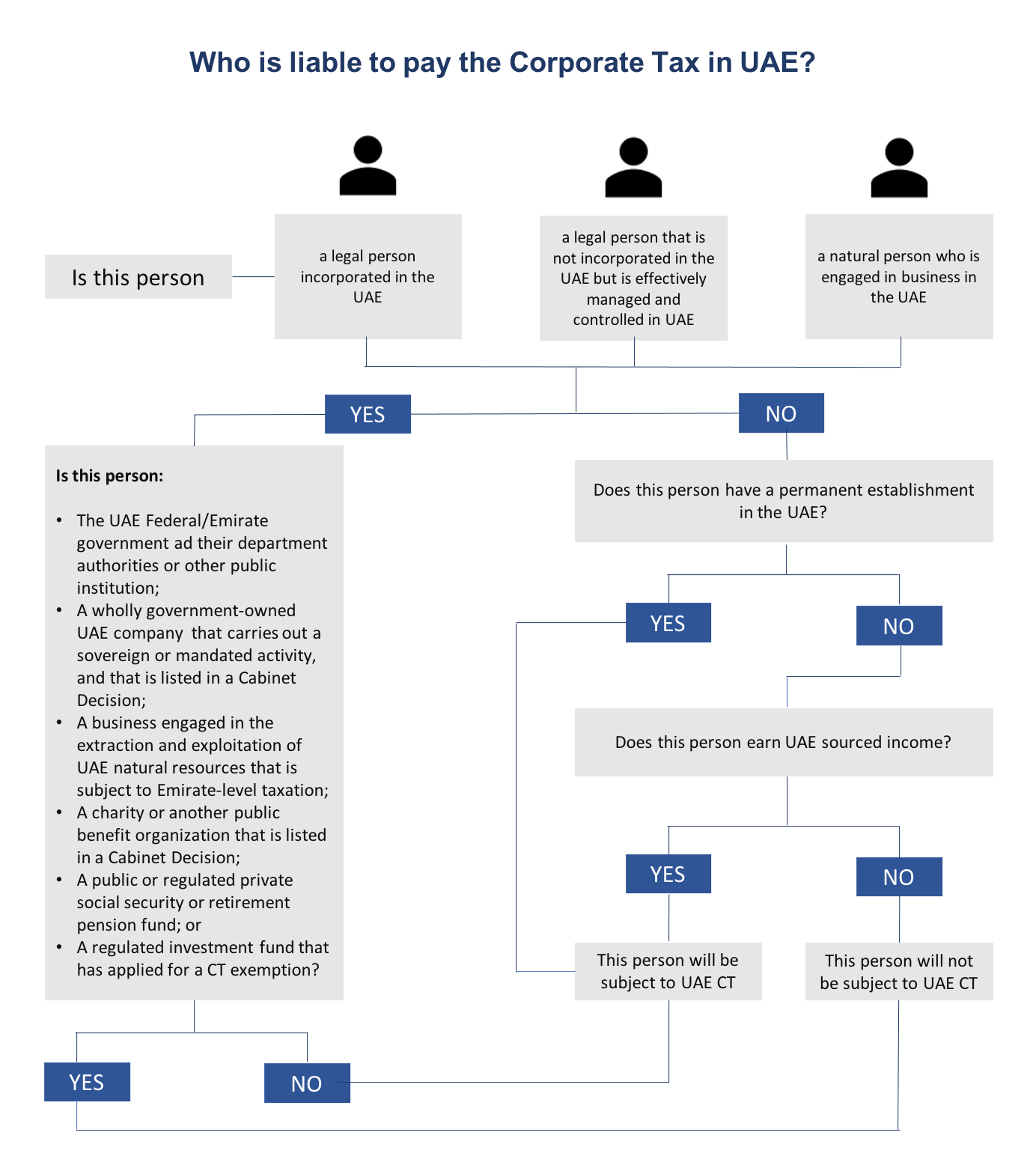

Who will be liable to pay UAE CT?

Resident Persons:

The CT Law would apply to all businesses and commercial activities in the UAE. Residency status is key in determining whether business profits will be subject to CT in the UAE. A UAE resident person will be taxable in the UAE on their worldwide income.

Non-resident Persons:

A Non-resident will be subject to UAE CT on the income sourced in the UAE. It will be subject to tax only if they have a Permanent Establishment (PE) in the UAE. A PE in the UAE will be determined by the following two tests:

- Fixed place of business test

- Dependent agent test

Free Zones:

Free Zone entities are also liable to CT. However, the rate of tax will be 0% subject to meeting specified exemption criteria.

Are natural persons (individuals) taxed under the UAE CT?

The individuals are not taxed under the Corporate Tax regime. However, income earned from carrying out business or commercial activities is taxable.

Salary income, income from real estate investments, and other investment income will not be taxed.

The real estate income will still be exempt if the investment is held through a private or family trust.

It is to be mentioned here that many investors have held the properties under Offshore entities or Restricted companies. Whether such entities/companies are considered as passthrough entities for CT is to be seen.

What is a UAE-sourced income?

Income may be considered as UAE sourced if:

- the income is earned from a UAE resident person, or

- if the payment is attributed to a PE in the UAE of a foreign company, or

- if the income is derived from the assets located in the UAE or from contracts performed in the UAE.

Who is exempt from paying UAE CT?

The following will be exempted from UAE CT:

- The federal and Emirates Governments and their dependents, authorities, and other public institutions.

- Entities or companies wholly owned by the Government.

- Businesses engaged in the extraction and exploitation of UAE natural resources.

- Charities and other public benefit organizations that are listed in a Cabinet Decision

- Public and regulated private social security and retirement pension funds.

- Regulated investment funds having exemption certificate from FTA.

- Individuals not earning income from business or commercial activities.

The Wrap...

Ministry of Finance is giving adequate time to individuals and businesses alike to make an assessment of their business and commercial activities to determine their taxpayer position.

LEAVE A REPLY

Related Topics

2 years ago

22 Mar 2023

KPI

UAE Tax Residency Certificate: Cost and Simplified Guide

Secure your UAE tax residency certificate with our simple step-by-step guide. Get started today and stay compliant!

2 years ago

04 Nov 2022

KPI

UAE Tax Residency Certificate (TRC): What? Why? And how?

UAE Tax Residency Certificate (TRC): What? Why? And how?

2 years ago

21 Jun 2022

KPI

How group companies are taxed? (UAE Tax Group)

Learn more about filing a single tax return for group companies under the new CT Law in UAE

2 years ago

21 Jun 2022

KPI

Corporate Tax: Loss carry forward - What, When and How much?

All the answers on Tax loss carry forward under the new Corporate Tax Law.

2 years ago

20 Jun 2022

KPI

UAE Corporate Tax Rates: How to Calculate your tax liability

Calculating your tax liability under the Corporate Tax Law.

2 years ago

06 Feb 2022

KPI

New Corporate Tax in UAE: All You Need to Know

The Corporate Tax Law is a Federal Law that will apply to all businesses and commercial activities(legal entities)in the UAE. Find out more.